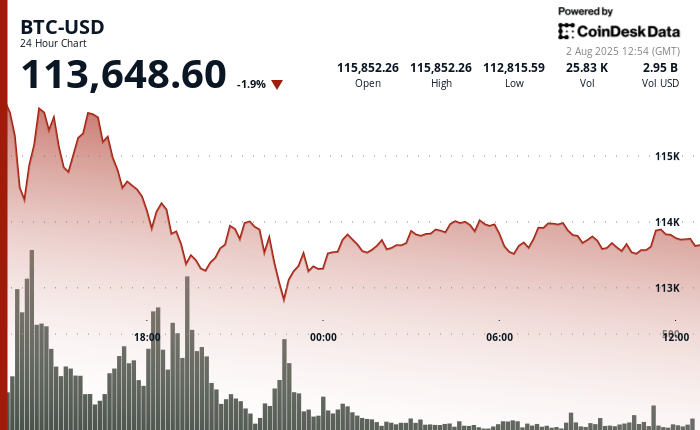

At the time of writing the editorial staff, according to Coindesk data, BTC was negotiated at around $ 113,648, down 1.4% in the last 24 hours. ETH, XRP, SOL and DOGE displayed higher drops, with ETH down $ 3.7% to $ 3,503, XRP reduced from $ 2.94 to $ 2.94, soil down 2.7% to $ 164.13 and DOGE dropped from $ 3.7%.

Friday, the slowdown followed a series of economic and geopolitical shocks that rocked the feeling of investors in the equity and digital markets.

American shares also closed the drop on Friday, with the DOW down 1.23%, the S&P 500 of 1.6%, and the composite Nasdaq plunging 2.24%while the merchants digested a disappointing job report, increased tensions with Russia and the possibility of relieving monetary emergency.

The July job report was a disaster – and a surprise

The American Labor Statistics Bureau (BLS) Friday that the American economy added only 73,000 jobs in July – well below expectations. More disturbing, however, was a revision downwards of 258,000 jobs for the combined totals in May and June, effectively efforcing most of the labor market gains previously reported for the second quarter.

The unemployment rate remained at 4.2%, but long -term unemployment increased from 179,000 to 1.8 million. The number of new entrants to the labor market jumped 275,000, indicating that more Americans are looking for work but find it difficult to find it. Participation in the active population was held stable at 62.2%, while the employment / population ratio fell from year to year.

Although employment growth continues in health care and social assistance, employment in most of the main industries – including manufacturing, construction, financial services and technology, has little or not changed. The markets have interpreted the data as a clear signal that the labor market is weakening faster than expected.

Trump accuses the BLS electoral interference commissioner, the chief’s orders were dismissed

President Trump responded quickly and publicly to the report on jobs, displaying a scathing message on Truth Social who accused the office of Commissioner for Labor Statistics Erika Mcentarfer – a person appointed by Biden – of manipulating data on employment as the 2024 elections approached.

“This is the same Bureau of Labor Statistics which overestimated job growth in March 2024 of around 818,000 and, once again, just before the presidential election of 2024,” wrote Trump. “They were records – no one can be so false?”

He added: “I ordered my team to dismiss this named Biden policy, immediately.”

The position alarmed investors, who considered rhetoric as a politicization of American statistical institutions. The deletion of a federal official responsible for economic data, based on allegations of election biases, added to the volatility of Friday, in particular for assets sensitive to rates and at risk such as crypto.

Trump’s nuclear submarine post degenerates the tensions of Russia

Later Friday, Trump was again to the realization of Truth Social, this time revealing that he had ordered two American nuclear submarines to reposition himself in response to recent remarks by Dmitry Medvedev, the former Russian president and current vice-president of the Russian Security Council.

“Based on the very provocative declarations of the former president of Russia … I ordered to position two nuclear submarines in the appropriate regions,” wrote Trump. “I hope it will not be one of those cases” where the words lead to “unexpected consequences”.

The unexpected message – delivered without preliminary briefing or confirmation of the Pentagon – aroused concern that diplomatic tensions with Moscow had entered a new phase.

Some considered Trump’s language as a deliberate posture rather than a real military threat, aimed at putting pressure on Russian President Vladimir Putin to consider a cease-fire in Ukraine. However, even if the declaration was not intended for an imminent action signal, it has always made the possibility of an American -Russian – but unlikely – nuclear confrontation, feels more real. Merchants – already in shock from the report of Friday morning jobs – respond by pouring risk assets in favor of safer Paris such as treasures and species.

The expectations of the decrease in Fed rates increase – but the fears of recession too

The dismal dismal data on Friday led merchants to considerably increase bets on a drop in rate at the September FOMC meeting of the Federal Reserve, many of which expected a reduction of 50 base points. But the prospect of an easier monetary policy has done nothing to reassure the markets.

Indeed, rate reductions are no longer considered a preventive decision to stimulate growth – they are now considered a reaction to an economic weakness that could already take place. In this context, monetary easing can be interpreted as a confirmation of the conditions of deterioration, rather than as a bull catalyst.

For cryptographic markets, which often reflect the feeling of the technological sector, the change of story weighed heavily. Despite the lower real yield potential, the fear of an imminent recession has overshadowed any short -term optimism. The result: generalized sale in digital asset space and renewed prudence before the main macro events later this month.