Bitcoin BTC galloped at a new record greater than $ 110,000 on Thursday, liquidating around $ 500 million in derivative posts in its wake, but some traders do not buy the bullish feeling.

The volume of negotiation jumped 74% in the last 24 hours while traders were trying to position themselves, but the majority of these traders choose not to fail – or to bet on the downcoin that descends.

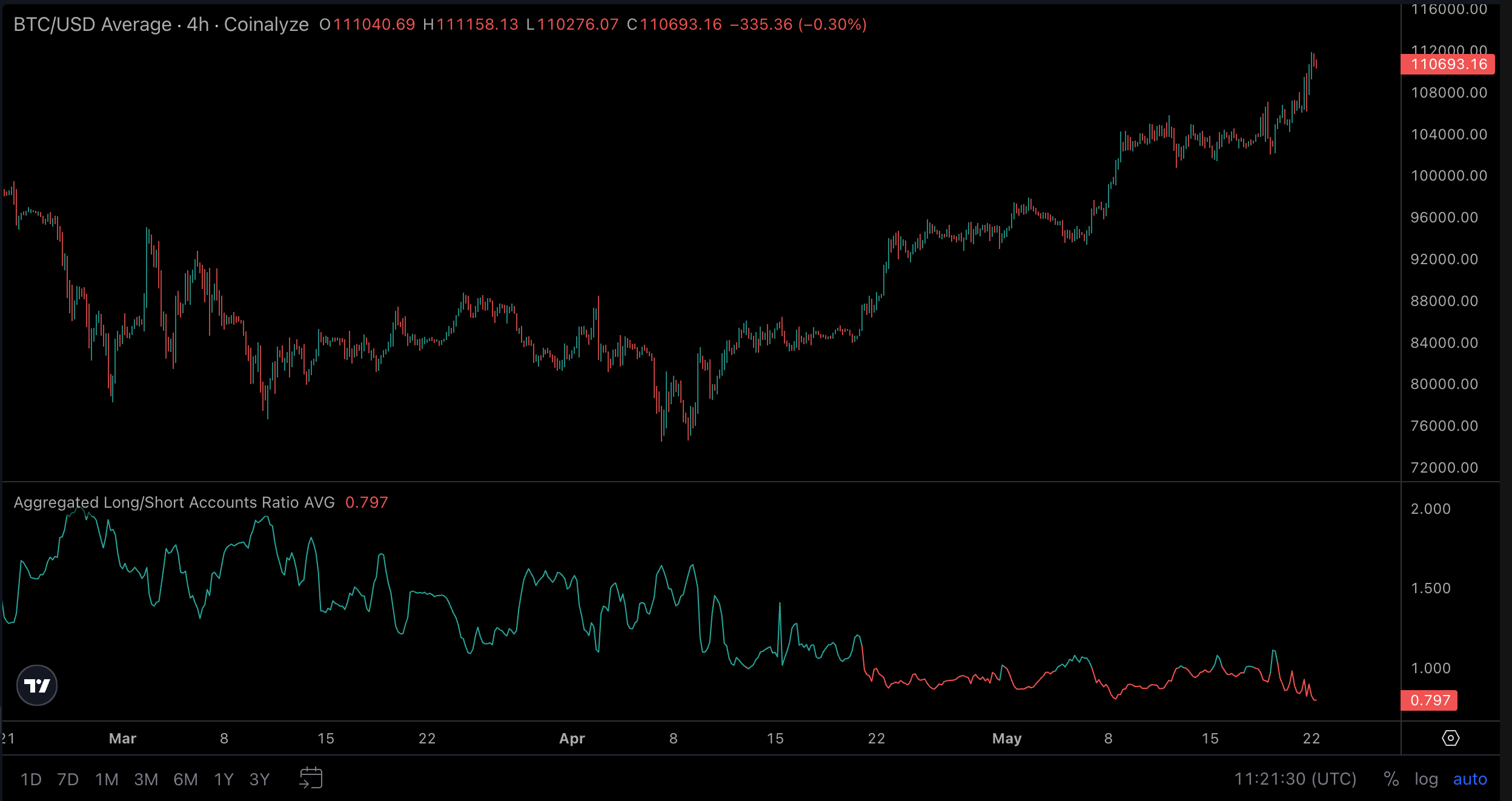

Coalyze data show that the long / short ratio has been at its lowest point since September 2022, which was in the middle of the crypto winter.

This trend began on April 21, while traders aggressively short-circuited the rupture over $ 85,000, apparently to the impression that Bitcoin had already formed its high cycle and that any subsequent decision would form a double summit.

However, despite a lack of participation in detail, Bitcoin continued to cringe higher, removing resistance levels at $ 97,000 and $ 105,000 on its way.

This decision can be attributed to a number of factors; A resumption of American actions as a tariff concerns has cooled, an increase in institutional activity on exchanges, such as the CME, and above all a richness of short positions to express and force higher prices.

Although these short positions can be considered to be lower in terms of market structure, they actually attract the flame upwards because it gives areas of optimistic traders to target and make loss hunts as we saw earlier this week.

Record execution of an asset is not necessarily a bad strategy; A merchant often chooses to enter a short position at a level of resistance, whether technical or psychological, and the losses of layer stop above where the thesis of a short exchange would be invalidated.

In this case, if a trader has short-circuited $ 105,000 on each of the BTC three tests in this area, he could have closed his position for three times at $ 102,000, which means that even if they were stopped in the trade at $ 109,000, it would be a profitable week.

In addition to the continuous increase in short positions, we have seen an open interest jumping disproportionately to the BTC. In the past 24 hours, the BTC increased 4.8% while open interest increased by 17% despite hundreds of millions of dollars.

This indicates that the record rupture is motivated by the lever effect and could be less lasting than the initial exceeding greater than $ 100,000 in December and January.

It remains to be seen whether the interest in short positions continues to increase if the BTC takes place with its capital movement above $ 111,000, but there is certainly a field of short position mines to tighten if it needs ammunition.

Read more: the Bitcoin rally to record the Hauts emphasizes $ 115,000 where an “invisible hand” can slow down the bull race