The Bitcoin increase (BTC) after the announcement of the Bitcoin Treasury strategy of GameStop Bitcoin stopped a little less at the level of $ 89,000 and things are now definitely lower during American negotiation hours on Wednesday.

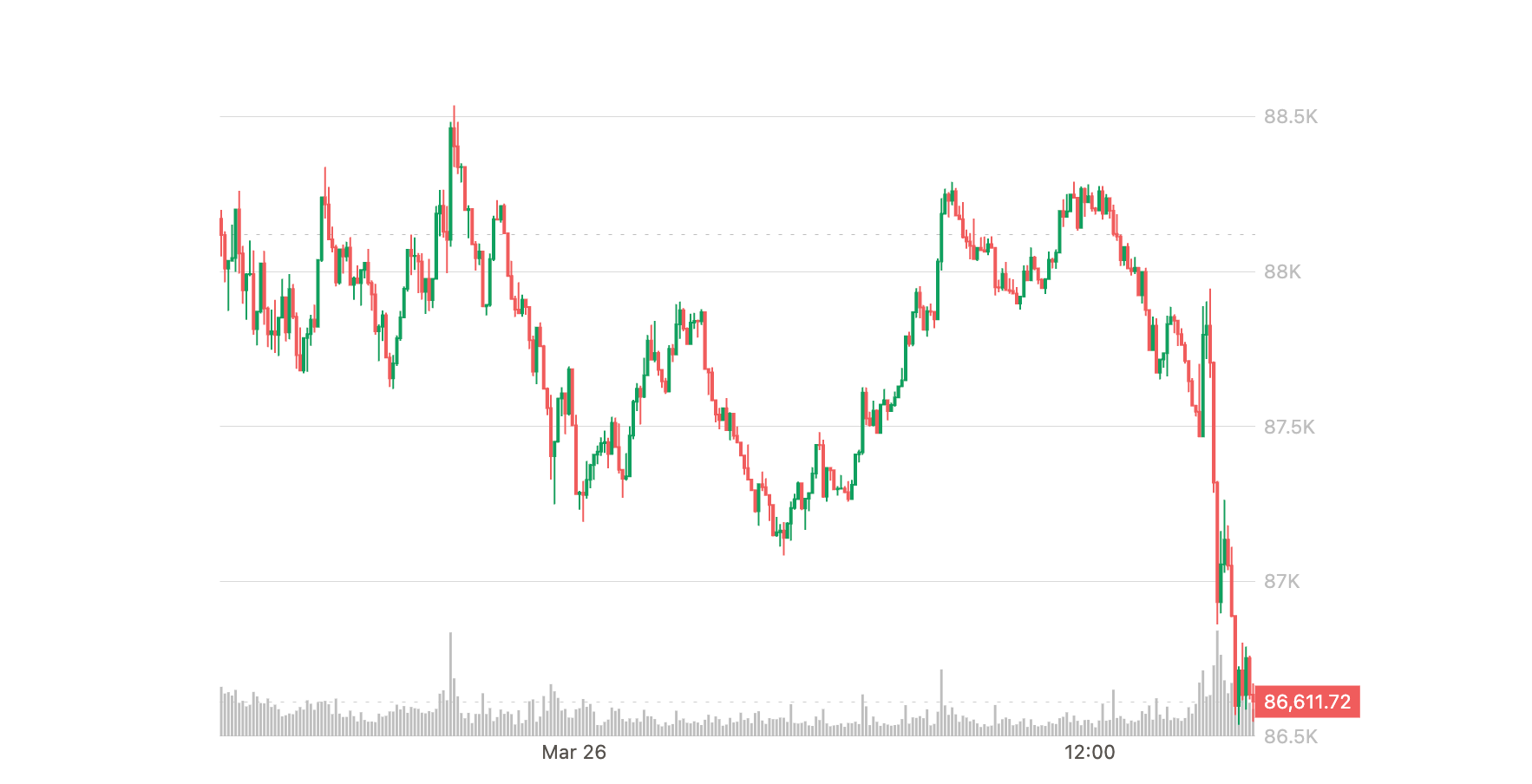

Just after midday on the east coast, Bitcoin fell to around 3% of the nights at $ 86,500. The Crypto Cropto Coindesk Crypto reference index was less than 1.9% in the last 24 hours, with ether (ETH), Solana (soil) and Aave decreasing from around 3% to 4% during the same period.

Price action occurred with American risk assets showing weakness. The S & P500 and NASDAQ indices fell 0.8% and 1.6%, respectively, erasing most of their earnings since the opening on Monday.

New concerns about the American debt ceiling may perhaps be loomed in the markets. The Congressional Budget Office has issued a warning today that the federal government could lack money from August if the legislators do not increase the limit of debt. The American prices, ready to enter into force on April 2, could also weigh on the nerves of investors.

“Uncertainty surrounding American trade policy and the broader political landscape remains in mind,” said Fund Hedge QCP analysts in a telegram program. “The market still lacks clarity on the scope, timing and the extent of these potential actions. Until then, we expect more lateral volatility.”

Does Gametop buy a bitcoin even bullish?

The Bitcoin Bulls, on the other hand, are again allowed to scratch their heads because the price does not react positively to the news of another deep pocket buyer who plans to invest in the largest crypto in the world.

“Zombie societies like Gamesop” pulling a Saylor “as a prison caught was cared for would be a clear topping signal,” said James Check, first a year ago, then Tuesday evening after GME’s announcement.

He recalled that he had said minors of similar traders, when these companies burn capital decided to stack the bitcoin beyond what their mining activity provided.

“Three months ago, I could not plead in case the side of the excess sale of this cycle as we saw on the 2022 bear market … I suspect that in a few months, I can make a case again.”