BNB is getting closer to the $ 700 mark while the traders responded to a new $ 1 billion token burns and an increasing interest in using assets as a business cash reserve.

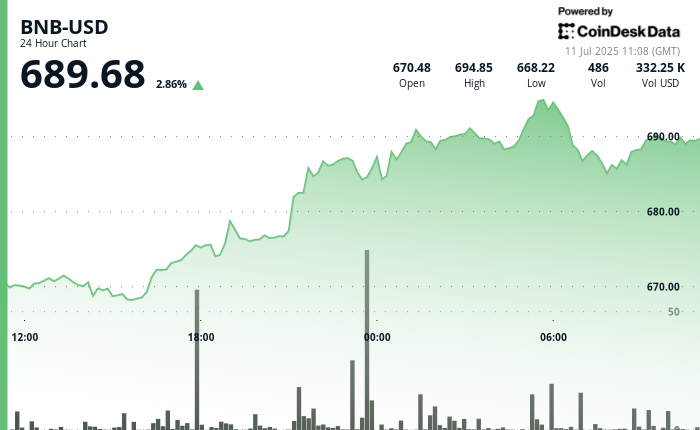

During the last period 24 hours a day, the BNB increased by around 2.8%, from $ 670.40 to $ 688.7. Trading increased as the price increased, in the middle of a wider cryptocurrency market rally which saw Bitcoin reaching a new record greater than $ 118,000.

The prize has briefly reached an intra -day peak nearly $ 695 before settling in a tight range around $ 689.

The Wally was not only powered by the upward crypto tide. The 32nd quarterly burn from Binance permanently removed approximately 1.59 million BNB from traffic, bearing the total burnt value at 265,605 BNB according to a tracking website.

Burns are part of a deflationary strategy aimed at reducing total supply to 100 million tokens.

In addition to this, more than 30 teams would have worked on means to structure the reserves of public enterprise in BNB, the investment company 10x capital supporting a plan for a BNB cash company of $ 500 million.

The addresses active on the BNB channel have doubled since March, oscillating about 2.5 million per day, according to Nansen Data. Likewise, the average daily transaction volumes have tripled.

Investors are looking to see if BNB can break the psychological barrier at $ 700 in the coming days.

Presentation of technical analysis:

- BNB won 2.77% over the period 24 hours a day, signaling a solid rise, according to the Technical Analysis model of Coindesk Research.

- Remote price of $ 27.51 (4.11%) Between a hollow of $ 667.61 and a summit of $ 695.12.

- The negotiation volume increased to 155,426 tokens at the end of yesterday’s trading, more than double the average of 24 hours of 64,169.

- The resistance is visible nearly $ 695.12, while the support emerged around $ 667.61.

- After the initial rally, prices consolidated in a narrow strip of $ 1.51 from $ 688.81 to $ 690.73.

- Solid support settled near the area from $ 688.80 to $ 689.00.

- The market briefly tested the resistance at $ 690.73 before relaxing in a controlled perspective.

Non-liability clause: Certain parts of this article have been generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.