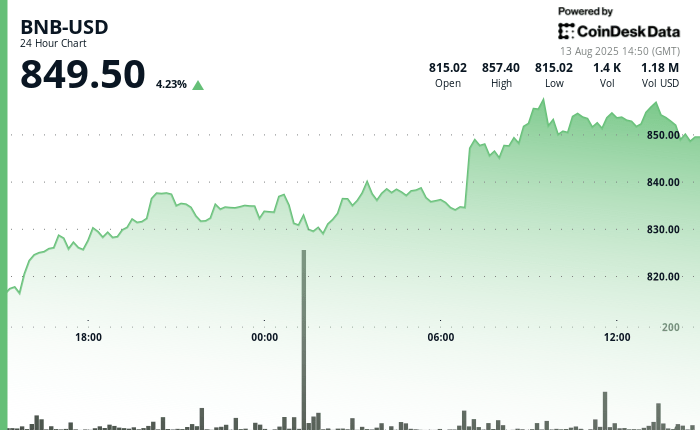

The BNB has climbed more than 4% in the last 24-hour period on a wider cryptocurrency market to rape the bar of $ 850 and near its top of all time at $ 860.

The token went from $ 813.90 to its summit during the session, allowed to browse key resistance points at $ 839.57 and $ 853.67 before undergoing sales pressure near the psychological level of $ 855, according to the Technical Analysis model of Coindesk Research.

The rally has grown after CEA industries acquired 200,000 BNB, becoming the largest holder of the asset company. This decision is part of an increasing trend in companies adding other cryptocurrencies to their reserves.

The negotiation volume has increased its daily average to almost three times, fueling optimism that institutional purchases could support the upward momentum. However, prices have withdrawn slightly in the final part of the session, suggesting a possible short -term consolidation.

Preview of technical analysis

Market data showed a strong purchase interest thanks to the rally, with a heavy negotiation activity establishing solid support nearly $ 834.40. BNB’s advance has released the resistance to $ 839.57 and $ 853.67, and prices exceeded $ 850 during most of the period, a sign that the accumulation remained in play while the momentum started to cool.

The rally peak coincided with a peak in sales orders, referring to profits that slowed down the push beyond $ 855. This sales pressure has created a downward divergence towards closure, where the token failed to recover higher land.

The wider cryptography market, as measured by the Coindesk 20 (CD20) Index, increased by 5.3% in the last 24 -hour period. BNB remained the dominant token in the exchange tokens, according to cryptocurrency data, representing more than 81% of their total market capitalization. It is about 1% of its record, while the second best token Leo, the best, remains about 8%.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.