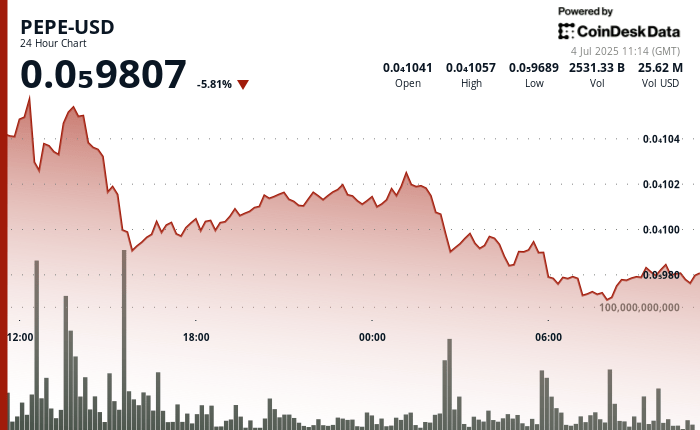

The same Pepe on the theme of frogs (DYNAMISM) It is slipped by almost 6% over the 24 hours, while Trump’s reciprocal deadline has sent undulations on the cryptocurrency market and exposed the volatility of the token.

The PEPE price has switched to a 16.5%negotiation range, emphasizing how fast the feeling can return to a market increasingly sensitive to geopolitical and macroeconomic signals when the negotiation volumes drop.

Behind the drop in prices, however, the big addresses seem unperturbed. Data from the Nansen Blockchain Analysis Society show whale wallets increased their pepe assets by more than 5% in the last month, which picks up the tokens now evaluated at around $ 3 billion, more than 70% of the PEPE supply.

Meanwhile, the total offer of PEPE on trade has slipped to a minimum of two years of approximately 247.2 billions of tokens, a decrease of almost 3% since the beginning of July, according to the same source.

Preview of technical analysis

Pepe had trouble maintaining gains after testing resistance almost 0.0000106, meeting the company’s sale pressure that lowered the price.

The part found the support of about $ 0.00,000,965, preventing it from sliding further, although the overall negotiation beach reflects persistent volatility, according to the Technical Analysis Data model of Coindesk Research.

The graphics show a descending chain shaping the recent price action, the sellers working on ascending movements. Trading volumes reveal a distribution scheme during price peaks, suggesting that traders unload positions rather than building new longs.

However, brief rebounds and overvoltages in the purchase of interest suggest that the same is not out of the fight. A burst of volume has helped to increase the modestly low prices, noting that some traders still see room for a rebound if the wider feeling of the market improves.