Ether (ETH)

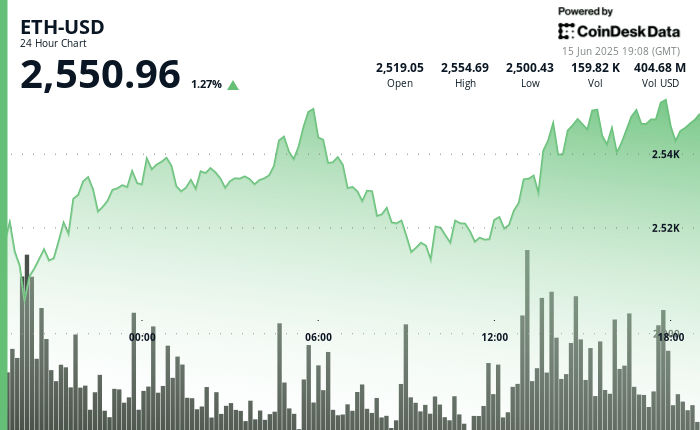

Negotiate over $ 2,540, showing strong resilience in the face of the turbulence of the market fueled by an increased geopolitical risk. After briefly plunging at $ 2,491.72, the ETH recovered quickly, closing higher on the volume above average and validating the key support almost $ 2,500, according to the Technical Analysis model of Coindesk Research.

The technical indicators suggest a renewed momentum, supported by training in two pools and heavy intrajournal shopping nearly $ 2,530. ETH’s open interests amounted to $ 35.36 billion at 6:05 p.m. UTC on June 16, according to Coinglass data, indicating active institutional positioning.

However, the ETFs, the ETFs of the United States, saw $ 2.1 million in net releases on Friday, ending a record sequence of 19 days, according to Farside investor data. Despite this, ETH continues to maintain its range between $ 2,500 and $ 2,800, which suggests that the bullish feeling is intact for the moment.

Help to support this story is a press release published Thursday by Ethealalize, a group focused on the bridging of institutional finances and Ethereum. The declaration announced the publication of “The Bull Case for Eth”, a complete report supported by ecosystem leaders like Danny Ryan, Grant Hummer, Vivek Raman and others. The report argues that Ethereum becomes the essential foundation of a digital global native financial system.

According to the report ”, the global economy undergoes a change in generation, with financial assets that are evolving more and more. Ethereum is positioned as the main layer of settlement allowing this transformation due to its decentralization, safety and availability. The reports indicate that Ethereum already feeds more than 80% of all tokenized assets and is the default infrastructure for stablescoins and deployments of institutional blockchain.

ETH, the native asset of Ethereum, is described not only as a reserve of value but also as a programmable guarantee infrastructure, calculation and yield fuel. The report says that ETH is largely undervalued in relation to its long-term public service and describes it as “digital oil”-a productive reserve asset which underpins a composible global financial ecosystem. He maintains that ETH should be a basic outfit in the long -term digital asset strategy of any establishment, completing the role of Bitcoin as a digital organ.

In short, while the macro -conditions remain volatile, the market behavior of Ethereum – combined with continuous institutional engagement and its increasing role as financial infrastructure – suggests that ETH could form a lasting basis for a future escape.

Strengths of technical analysis

- ETH exchanged between $ 2,500.43 and $ 2,554.69, closing the summits close to the session at $ 2,542.

- A double -back structure developed nearly $ 2495 at $ 2,510, supported by a volume above average.

- The resistance was tested at $ 2,553, but a strong hourly closure on 158,553 ETH volume signals has renewed the momentum.

- A rebound in the form of V followed a hollow at $ 2,529, driven by points at 13:43 and 13:46.

- Continuous purchase could push ETH to $ 2,575 to $ 2,600 in the short term.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.