XRP has extended gains greater than $ 3.00, while institutional offices have pressed high volume offers, confirming a short -term floor almost $ 2.99. The deployment of SBI loan from Japan and a waiting and waiting and waiting decision -making cycle framed the movement, with resistance at $ 3.10 after heavy prints.

New context

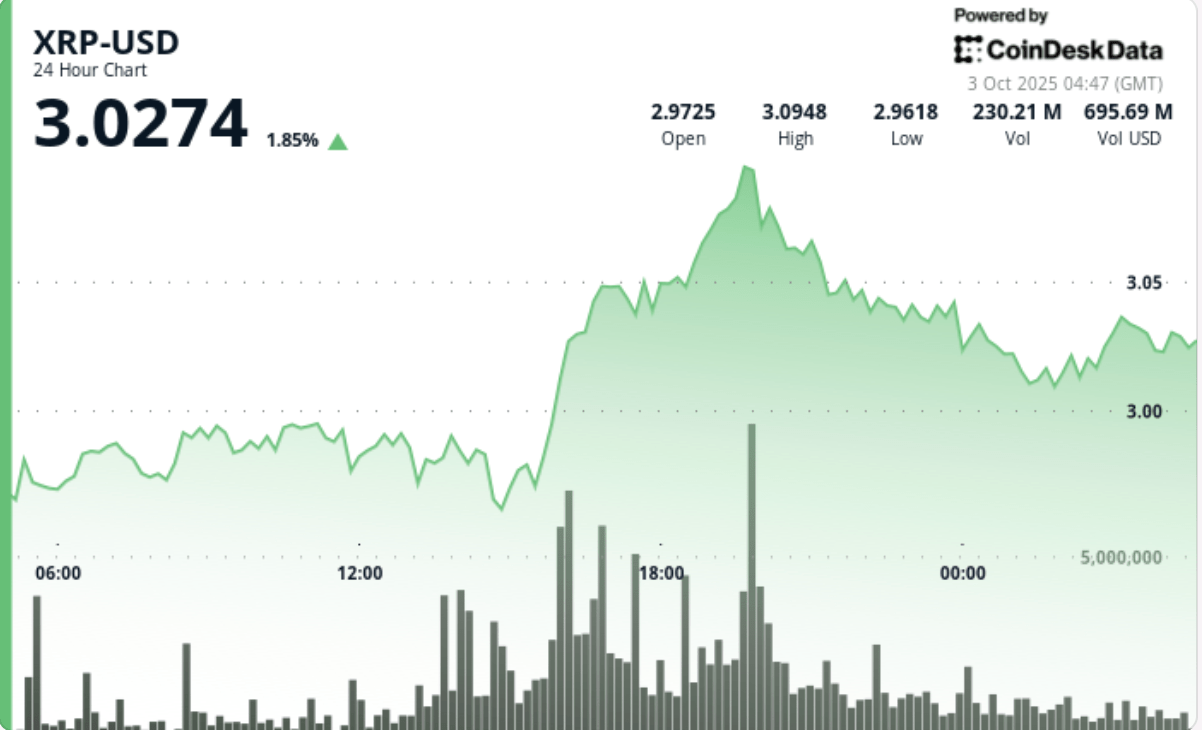

XRP climbed 3% between October 2, 04:00 and October 3, 3:00 am, from $ 2.98 to $ 3.03. The rally followed the expansion by SBI Holdings of the XRP institutional loan services, signaling the deepening of the Japan crypto. Meanwhile, CTO Ripple David Schwartz announced its departure after 13 years, and seven ETF XRP applications remain during the SEC exam, the first decisions expected on October 18. The prediction markets are now approval ratings above 99%, strengthening speculative entries.

Summary of price action

- XRP exchanged a corridor of $ 0.15 (range of 4.9%) between $ 2.95 and $ 3.10.

- At 4:00 p.m., the price went from $ 3.00 to $ 3.06 out of 212.6 million tokens – more than double the daily average.

- The resistance was harded at $ 3.10, where 129 m of turnover capped upwards.

- XRP consolidated between $ 3.00 and $ 3.05, higher signaling accumulation of the $ 3.00 line.

- During the last hour, XRP went from $ 3.03 to $ 3.02 in the middle of the profits, with a peak of 2.35 million at 03:55 showing an institutional rebalancing.

Technical analysis

The support is confirmed nearly $ 2.99 to $ 3.00, with several defenses holding the level. The resistance remains defined at $ 3.10, where institutional sellers have concentrated. The session carved a consolidation strip greater than $ 3.00, suggesting a professional accumulation. The escape attempts directed by the volume validate institutional participation, although the conviction remains attached to a fence supported above $ 3.10 to unlock the next leg around $ 3.20.

Which traders are looking at?

- The question of whether XRP can maintain closes above $ 3.00 and Rettester $ 3.10.

- The institutional positioning moves before the ETF time of October 18.

- SBI loan flows and their impact on Asian liquidity trends.

- Larger CD20 index confirmation, as alt rotations follow the force of XRP.