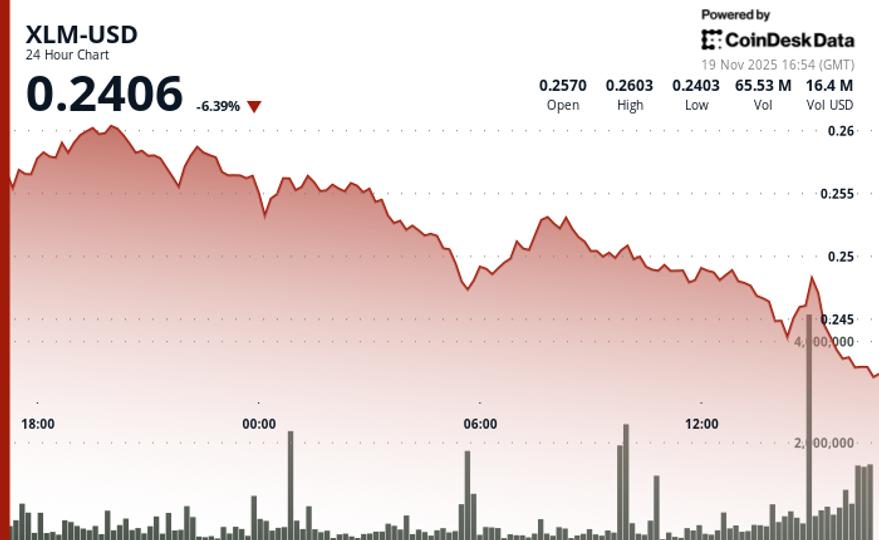

Stellar (XLM) slipped 1.6% on Tuesday from $0.2491 to $0.2451 as sellers took control and the token extended a series of lower highs from its recent high of $0.2602.

The asset traded in a range of $0.0153, showing an intraday volatility of 6.2%. A strong volume spike at 05:00 of 36.3 million XLM – 78% above the 24-hour average – confirmed a breakdown below the key support level of $0.2520.

In the absence of clear fundamental catalysts, traders focused on the technical picture, where the $0.2520 loss signaled likely institutional distribution rather than retail-driven volatility.

The bearish momentum intensified on the hourly chart as XLM fell another 0.8% from $0.2478 to $0.2453. Two waves of energetic selling pushed the token below $0.2470 and $0.2460, with consecutive volume increases of 1.71 million and 1.69 million tokens during a one-minute window, more than eight times the usual levels.

Key Technical Levels Signal Continued Pressure for XLM

Support/resistance analysis:

- Immediate support holds at the session low $0.2449.

- Strong resistance was confirmed near the $0.2600 level.

- Critical support breakdown completed at $0.2520.

Volume analysis:

- The peak volume of 36.3 million marked 78% above the daily average.

- More than 1.7 million consecutive volumes increase during an outage.

- Normal 8x volume levels confirmed institutional selling.

Chart templates:

- Pattern of consecutive lower highs from the $0.2602 high.

- Acceleration of bearish momentum thanks to support violations.

- The two-wave selling structure dominates the 60-minute chart.

Targets and risk/reward:

- The downside target is at $0.2430 if the momentum continues.

- Resistance builds at $0.2520 as old support reverses.

- The key reversal level remains at $0.2600 for recovery attempts.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.