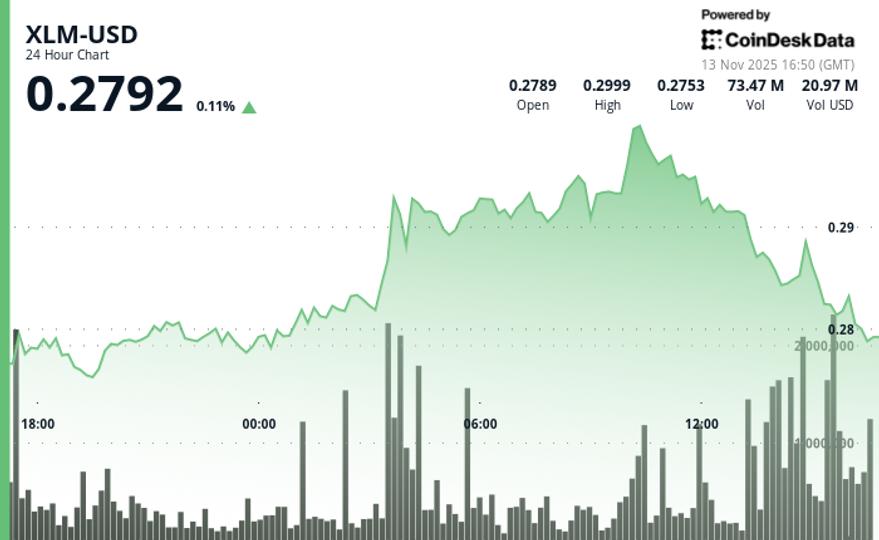

Stellar faced selling pressure during Tuesday’s session, with XLM sliding from $0.2846 to $0.2812 as institutional distribution emerged at high levels. The token has carved out a range of $0.0189, representing 6.7% volatility that signals increased trader uncertainty regarding current price levels.

The outage accelerated at 2:00 p.m. when trading volume reached 76.24 million tokens, 115% above the 24-hour average of 35.4 million. Price tested resistance near $0.290 before sellers overwhelmed buyers, pushing XLM through the critical $0.285 support zone that had anchored previous consolidation attempts.

Recent data from 60 Minutes shows that XLM fell from $0.289 to $0.281, marking a sharp 2.8% decline characterized by lower highs and lower lows. Bears took control at key junctures at 3:44 p.m. and 3:47 p.m., with volume surpassing 1.9 million as price action fell decisively below the $0.285 level.

Key Technical Levels Signal Downside Risk for XLM

Support/resistance analysis:

- Primary resistance established at $0.294 after session highs.

- Critical support zone now at $0.281 after decisive breakdown.

- Secondary support target identified in the range of $0.278 to $0.280.

Volume analysis:

- The 24-hour volume climbed 26.06% above the 7-day average during the outage.

- The peak in institutional activity at 76.24 million shares coincided with the rejection of resistance.

- High selling pressure maintained above 1.9 million during key breakout moments.

Chart templates:

- A clear trading range between $0.281 and $0.294 established during the session.

- The pattern of lower highs and lower lows confirmed a change in bearish momentum.

- The failure of the escape attempt validated the distribution thesis at higher levels.

Targets and risk management:

- Immediate downside target: support zone $0.278 to $0.280.

- Risk level for any rebound attempt: former support at $0.285 now resistance.

- Volume confirmation required above 2M for sustained directional movements.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.