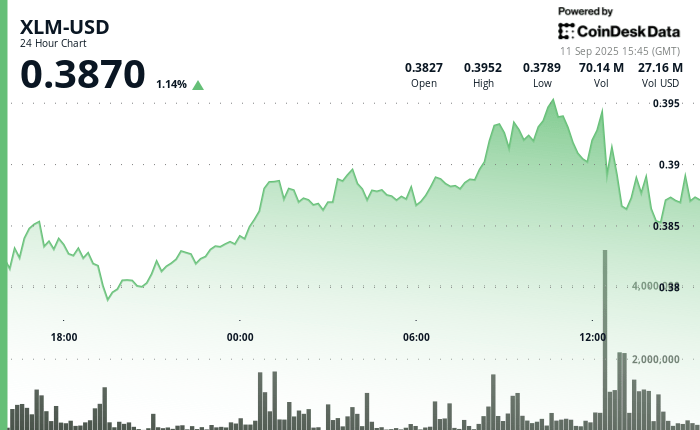

XLM displayed net fluctuations in the last negotiation cycle 24 hours a day, oscillating in a strip of $ 0.017 which marked a fluctuation of 4.3% between $ 0.379 and $ 0.396. The token rally took shape around midnight on September 11, when prices went from $ 0.384 to a summit of $ 0.396 in the middle of the morning.

The upward thrust came next to an increase in market activity, underlined by an increase of 112 million units in volume at noon – well above the typical averages. However, the momentum has Failed and XLM returned to $ 0.387, confirming the resistance of the company in the area from $ 0.394 to $ 0.396.

The broader trading context has highlighted the interaction between macro and micro-comics. Institutional participation on the market scale and the broader volume of the feeling of cryptography, while the technical ceilings have limited the advanced advances.

Traders saw buyers systematically absorbed at $ 0.394 to $ 0.396, while the accumulation of almost $ 0.379 to $ 0.381 underlined an emerging support base.

On a shorter horizon, XLM’s performance between 1:14 p.m. and 2:13 p.m. on September 11 captured the consolidation dynamics. The assets maintained a tight range of $ 0.003, fluctuating between the support at $ 0.386 and the resistance at $ 0.389.

During this window, two short -lived bursts of Haussier activity briefly pushed the price to $ 0.389 on a strong volume, only to deal with an immediate rejection. Repeated failures at this level strengthened the importance of $ 0.389 as an online ceiling with the 24 -hour trend.

Overall, the model reflects a market that always tests its limits. While high volume overvoltages have interest and participation, repeated rejection at resistance levels signals the distribution pressure limiting the increase potential. For merchants, technical history depends on the question of whether XLM can convert $ 0.389 to support, or if the continuous sale will require another retest from the base from $ 0.379 to $ 0.381.

Distribution of technical indicators

- Volume analysis: an extraordinary increase of 112.18 million volumes considerably exceeded the standard references of 24 hours, institutional signaling participation.

- Support levels: Robust support establishment identified in a range of $ 0.379 to $ 0.381 where accumulation interests were previously developed.

- Resistance zones: final resistance confirmed at $ 0.394 to $ 0.396 level comprising several rejection instances on an amplified volume.

- Price range: 4.30% The spectrum of volatility illustrates substantial intraday trading possibilities for committed market players.

- Escape model: the break-out initiative of the midnight session failed to maintain an increase dynamic beyond critical technical barriers.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.