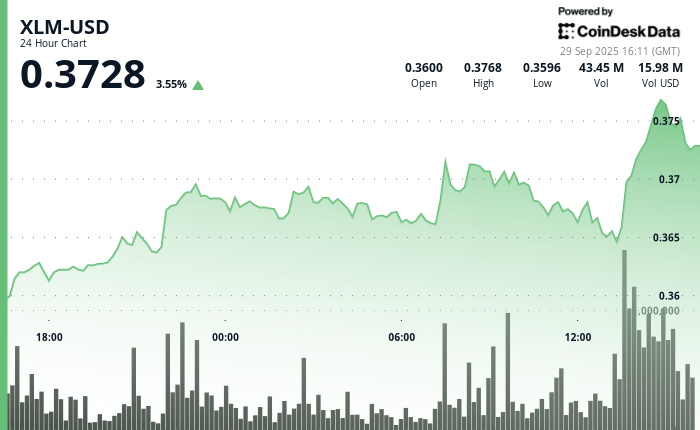

Stellar XLM’s native token posted a solid rally in the last 24 hours, climbing $ 0.36 to $ 0.36 on a heavy commercial activity. This decision was fueled by two separate rupture phases: an evening wave on September 28 at 10:00 p.m. which brought prices to $ 0.37 on the volume almost double the daily average, followed by a secondary thrust at 1:00 p.m. the next day which strengthened the optimistic momentum. The two sessions were supported by volumes raised greater than 31 million units, pointing out a large market participation.

The last hour of negotiation of September 29 proved to be particularly explosive, XLM progressing by 1.64% between 1:10 p.m. and 14:09. An escape began at 1:42 p.m., marked by a highlight of net volume greater than 1.9 million units on a single candle. This overvoltage brought the price per resistance to $ 0.366, establishing a new upward channel. XLM continued to touch intrajournal peaks nearly $ 0.372 before consolidating yourself just below $ 0.371 while the volumes spanned.

The momentum for the Stellar token intervenes while the project continues to extend its footprint in the Asia-Pacific region. Stellar has strengthened its cross-border payment partnerships with the banks of Southeast Asia while developing Soroban, its intelligent contract platform designed to expand the capacities of the network. These movements align with the growing adoption of the payment infrastructure based on blockchain within traditional finances, in particular for international transfer systems.

With XLM still negotiating under the $ 1.00 threshold, the token has also attracted retail merchants who consider low -cost digital assets such as entry points accessible in blockchain ecosystems. Combined with the institutional interest highlighted by high volume rashes, Stellar’s recent performance highlights its positioning both as a retail token and a serious competitor in cross -border financial innovation.

Technical indicators report continuous strength

- XLM goes up from $ 0.36 to $ 0.37 with $ 0.01 by posting 3.70% of gains in 24 hours a day ending on September 29, 2 p.m.

- The initial escape reaches $ 0.37 to September 28 10 p.m. on the unit volume of 31.93 million, crushing 18.47 million daily means

- Secondary overvoltage reaches $ 0.37 to September 29 1:00 p.m. with 31.61 million unit volumes

- Last 60 minutes from 1:10 p.m. to 2:09 p.m., deliver an explosive acceleration 1.64%

- Breakout was launched at 13:42 with a volume that made its doors beyond 1.9 million units on 13:43 Candle

- The priced price $ 0.37 resistance, establishing a new upward channel structure

- Basic support forms at $ 0.37 with PEAK TOUCHING session $ 0.37

- Consolidation almost $ 0.37 on the volume declining closing minutes

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.