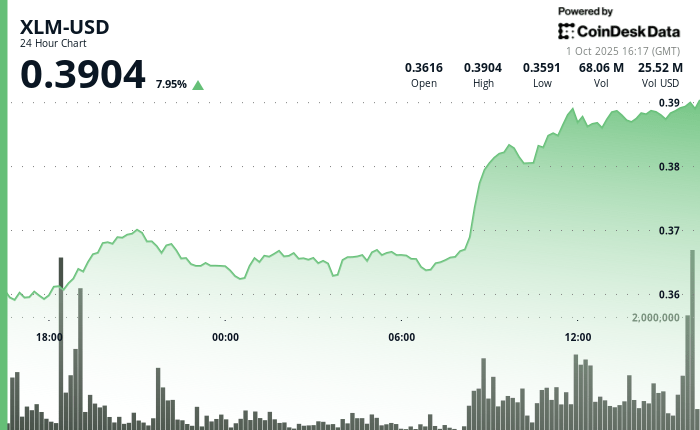

XLM posted a volatile negotiation session in the last 24 hours, from $ 0.36 to $ 0.39 before giving gains in an intraday net reversal. This decision represented an increase of 7% while volumes increased to 56.77 million, which doubles the 24 -hour average, which constitutes an increased institutional activity.

The most notable escape occurred at 8:00 am UTC on October 1, when the price went from $ 0.37 to $ 0.38 on an exceptional purchase pressure, establishing company support at $ 0.37.

The momentum took place during the following hours, with trading volumes exceeding 55 million during the sessions of 9:00 a.m. and 11:00 a.m. This coherent request has confirmed a change in market structure, transforming resistance almost $ 0.38 into support while producing a higher bottom chain that has strengthened the upward trend. Analysts often consider this scheme as proof of accumulation by larger players positioning themselves in front of key resistance levels.

This momentum, however, turned out to be ephemeral. During the last hour of the session, XLM increased from $ 0.39 to $ 0.37 while the profit taking. The net sale at 13:41 UTC, which lowered the prices by two hundred in less than 30 minutes, erased a large part of the previous gains and created a lower bass which disturbed the upward trend. Institutional merchants seemed to lock the profits after the rapid rise, stressing the fragility of the recent bullish impetus.

The Whipsaw session highlights the wider uncertainty weighing on the cryptocurrency markets. While XLM briefly disputed the psychological resistance of $ 0.40, its rapid rejection highlights continuous volatility between digital assets in the middle of macroeconomic opposite winds. Merchants will now look at if $ 0.37 can contain as a sustainable support area – or if the breakdown signals weakness in advance.

Technical indicators show mixed signals

- The price escape took place on October 1 08:00 with an exceptional volume of 56.77 million, considerably exceeding the average of 24 hours of 29.36 million.

- Robust volume support established at $ 0.37 during the initial overvoltage phase.

- The dynamics of food resistance validated a level of about $ 0.38 with a sustained institutional accumulation.

- Higher bottom model maintained throughout the ascending trajectory before the inversion of final hours.

- The volume increased spectacular during the drop phases at 13:18, 13:44 and 13:49, readings exceeding 1.3 million.

- A zero volume recorded at 2:09 pm suggesting a complete exhaustion of the market and a potential future consolidation.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.