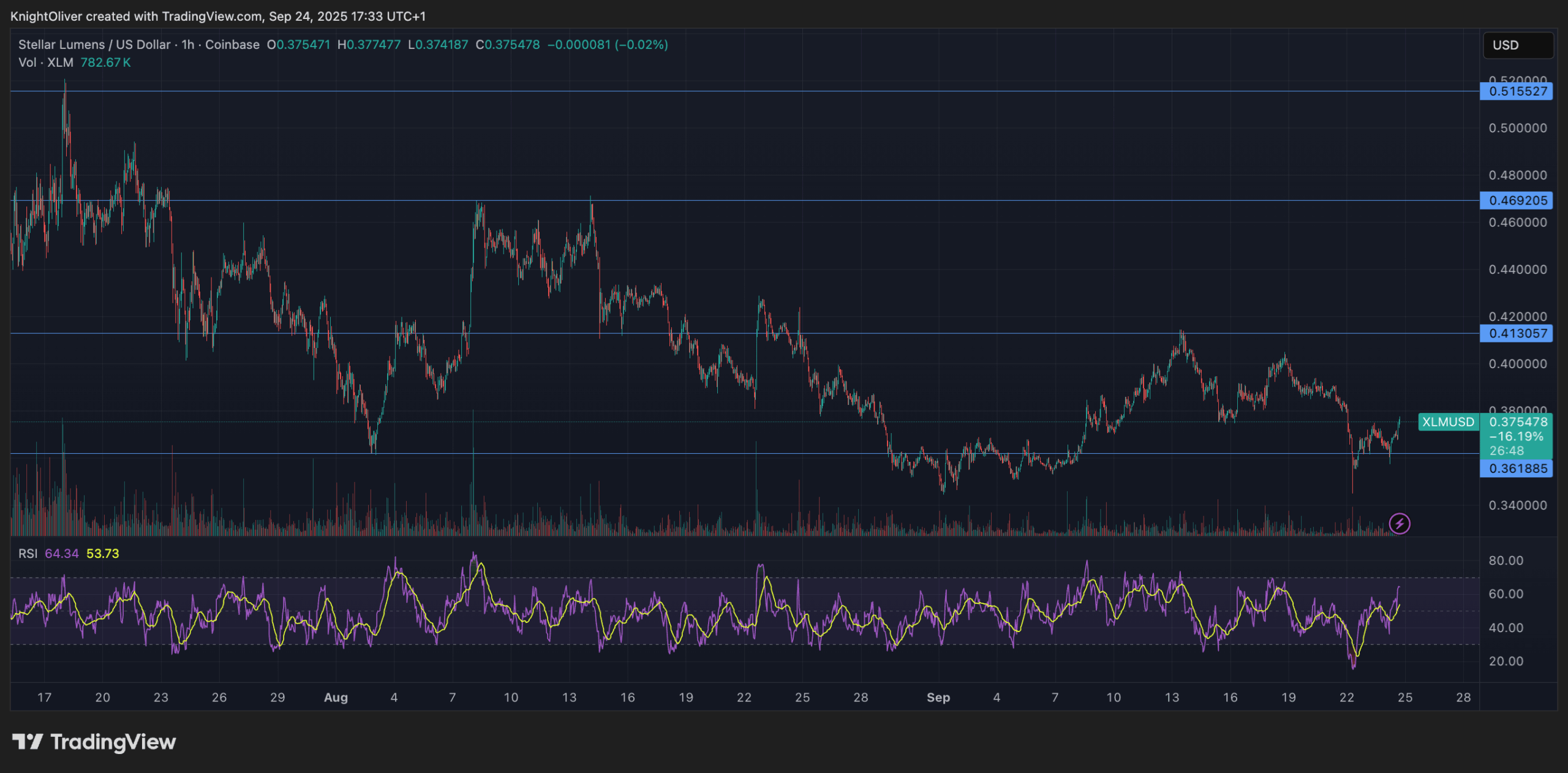

Stellar’s native token XLM has resisted intense volatility in the last 24 hours, plunging at key support levels before staging a robust rebound. The moves, marked by an unusually heavy institutional negotiation activity, stressed the accent put by the market in the support zone from 0.36 to 0.37 $ as traders weigh the prospects of an escape to higher targets.

During the Asian negotiation session, XLM dropped $ 0.36 over volumes exceeding 40 million, more than double the average 24 hours a day – soliding this price area as high volume critical support. The sale was quickly absorbed, the token dates back to $ 0.37, a sign that institutional players can accumulate positions at reduced levels.

The last hour of negotiation on September 24 was particularly turbulent. XLM slipped strongly to $ 0.368 at 13:37 before recovering from the session peaks of $ 0.369 per 14:10. The volume peaks at 13:37 (1.27 million), 13:58 (1.19 million) and 13:59 (1.58 million) highlighted significant institutional flows stimulating intra -day fluctuations.

Technical indicators signal consolidation schemes

- The price range of $ 0.01 representing 4% volatility indicates active negotiation interest.

- High volume support test at $ 0.36 with 40.69 million in negotiation volume.

- Recovery to $ 0.37 during Asian negotiation hours suggests institutional purchases.

- The critical support zone established about 0.36 psychological $.

- The volume tips at the last hour indicate an important institutional activity.

- Consolidation model training greater than $ 0.37 Support area.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.