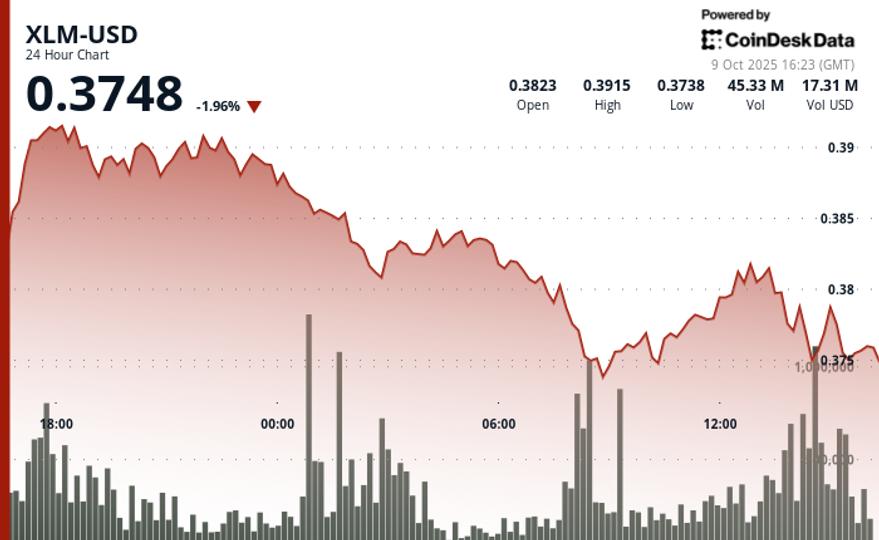

Stellar’s XLM token extended its decline over the past day, sliding 5% from $0.39 to $0.38 between October 8 at 3:00 p.m. and October 9 at 2:00 p.m. The sell-off occurred against a backdrop of intense institutional activity, with volumes reaching 35.51 million – well above average levels – confirming strong pressure on distribution.

The break below the key support level of $0.38 marked a clear change in sentiment as trading intensified within a tight range of $0.019. Market structure analysis showed the formation of a descending channel pattern, with repeated rejections near $0.38, suggesting sustained bearish control.

During the final hour of trading, from 1:13 p.m. to 2:12 p.m. on October 9, XLM lost another 1%, with significant volume spikes at 1:52 p.m. and 2:01 p.m., signaling coordinated institutional selling. Analysts said the move reflected continued liquidation at professional trading desks rather than short-term retail action.

Technical indicators signal further weakness

- Failure of critical support at $0.38 accompanied by institutional grade volume of 35.51 million exceeding standard trading metrics

- Downtrend established with successive lower highs indicating systematic institutional distribution

- Resistance zone established at $0.39 where institutional selling has consistently emerged during recovery attempts

- Above-average volume participation during price reversals, confirming coordinated institutional distribution strategies

- The technical chart pattern shows the formation of a descending channel with lower highs at key resistance levels.

- Failed recovery attempts near $0.38 were regularly met with institutional bidding indicating strong overhead resistance.

- Concentration of volumes during declining phases with 1.34 million at 1:52 p.m. and 1.43 million at 2:01 p.m. confirming institutional participation

- Technical momentum indicators suggest continued downward pressure towards the psychological support level of $0.38.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.