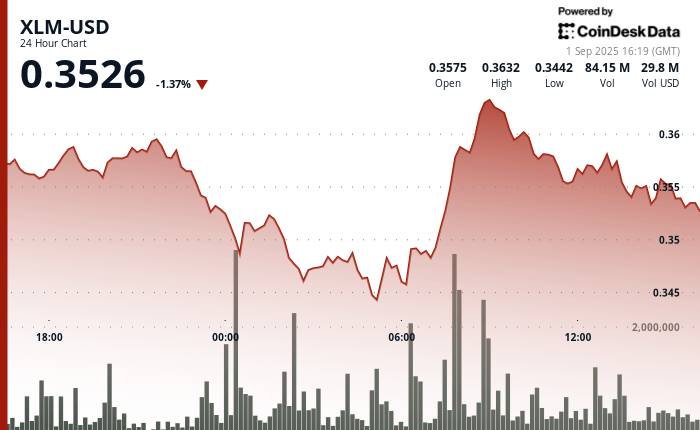

The native token of Stellar XLM has undergone high sales pressure in the last 24 hours, exchanging a tight but punishing variety of 5% between $ 0.34 and $ 0.36. The session began with relative stability before an end of the end of the end passes the token from its summit from $ 0.36 to $ 0.34.

The negotiation volume exceeded 57 million units at midnight while the market tested support around the $ 0.34 to $ 0.34. Buyers fell early the next morning, briefly going back to $ 0.36 on the back of what seemed to be an institutional accumulation, with volumes inflating to 70 million units.

Despite the recovery, the price action obtained approximately $ 0.36, creating a structure linked to the beach which, according to technical traders, often precedes a directional escape. The last hour of negotiation on September 1 showed a downward momentum with control, XLM slipping 1% when the consolidation model broke down.

Intrajournal data has highlighted an acceleration of sales pressure between 1:45 p.m. and 13:46, when more than 1.28 million tokens changed hands down the day. The recovery attempts collapsed before the end, and a lack of activity in the last minute suggested that trading had actually stopped.

The fundamentals of the token were also tested by the developments linked to exchange and to the network. Bithumb in South Korea announced that it would suspend XLM deposits on September 3, while Stellar implements network upgrades, a temporary disturbance that underlines the blockchain transition to a critical upgrade phase this month.

At the same time, the completion of pilot tests by Ripple with the banks has strengthened a wider confidence in the payment solutions based on the blockchain, exerting additional pressure on stellar to provide competitive improvements.

Institutional activity peak volume

- The negotiation range of $ 0.02 represents a spread of 5% between the $ 0.34 support and the resistance of $ 0.36 during the session.

- Midnight Seloff generates a peak of 57 million volumes indicating a strong institutional sale.

- The morning overvoltage reached $ 0.36 out of 70 million volumes suggesting an accumulation phase.

- The resistance confirmed at $ 0.36 with a support area established approximately $ 0.34 to $ 0.35.

- The attempts to recover the final hour fail as the downside is accelerating.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.