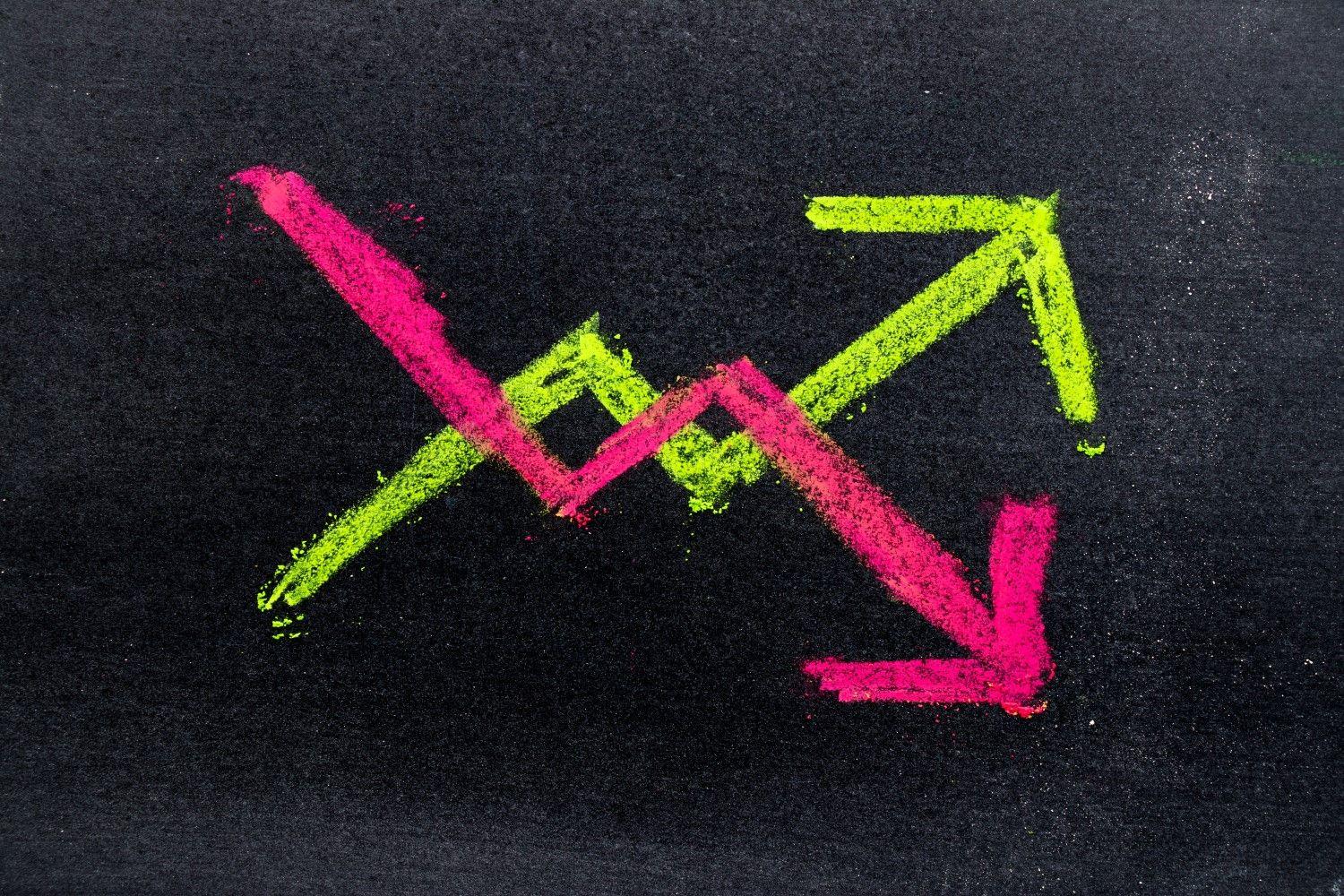

DRIBIT options reveal a striking divergence in the feeling of great cryptocurrencies, with bullish positioning in XRP and Solana (Soil contrasting with persistent decrease fears in Bitcoin (BTC) and ether (Eth).

At the time of writing the time of writing, the XRP purchase options or the Haussiers bets were more expensive than the dishes on all tenors, according to the source of Amberdata data. Remain, the expiration calls in December exchanged a 6 -point Put Volatility bonus, indicating a bias for an end -of -year rally. XRP, the cryptocurrency focused on payments, is the third largest by market value.

The soil options have also shown optimization, with calls from December which exchange a bonus of 10 flight points at points.

A purchase option gives the buyer the right, but not the obligation, to buy the underlying assets at a predetermined price no later than a specified future date. It represents a bullish bet on the market, while a sales option provides against price slides.

The positive tone of XRP is probably motivated by a renewed enthusiasm around the potential approval of the funds negotiated on the points (ETF) In the United States, at least six major issues, including Bitwise, 21Shares, Wisdomtree, Coinshares, Canary Capital and Franklin Templeton, have requests or active changes to the Securities and Exchange American Commission (SECOND).

The SEC has delayed decisions on these deposits, pushing key approvals, such as WisdomTree ETF XRP in late October 2025. While these deposits are in a similar examination period, the market seems to be preparing for a synchronized approval or rejection event which could have a significant impact on the price of XRP.

The XRP community is very optimistic, looking at substantial price gains by the end of the year if the ETFs are approved.

“The basic case of debit of the first month: $ 5 billion +. Independent market offices PEG PEP of the first month Spot ETF ETF at $ 5 billion + before reflexive prosecution. It is a serious demand shock to a supply that is partly locked and concentrated,” said the popular ppimius XRP pimpius pimpius potential year for XRP. Cryptocurrency is currently negotiated at around $ 2.88, according to Coindesk data.

The optimism of the soil probably stems from approval RCE from the upgrade of Alpenglow of its Parental Solana blockchain, which is likely to increase the speed of the network. Bitget chief analyst Ryan Lee called him “decisive moment for the network trajectory”.

“”Approval of Alpenglow’s Solana’s upgrade with more than 98% Staker support marks a decisive moment for the network trajectory. The reduction in the finality of transactions from 12.8 seconds to only 100 to 150 milliseconds transforms Solana into one of the fastest blockchains in operation, unlocking the possibilities that extend far beyond the marginal efficiency gains, “ Lee said in an email.

Lee said that speed speed would accelerate Solana’s adoption in real -time trading, high frequency strategies and transparent chain arbitration. He explained that the design of Alpenglow corresponds to the blockchain regulation speeds with traditional financial systems, overcoming a major obstacle for institutions hesitating to adopt decentralized infrastructure. This alignment makes Solana an attractive and evolving blockchain option for institutional use.

BTC and eth

The feeling concerning Bitcoin seems decisively down, as the PUTs are a higher price than the calls for the expiration trade of March 2026.

The BTC rally exceeded $ 100,000, the prices that find it difficult to rally after the disappointing report of American jobs on Friday, which has increased expectations for Fed rate drops. Analysts blamed the slowdown in FNB entrances, the realization of the profits by long -term holders and the rotation of whales in the ether for the action of the BTC price.

That said, the options linked to Ether also showed a bias for the expiration of December. ETH fell sharply at $ 4,300 from the record summit of almost $ 5,000 reached last month.