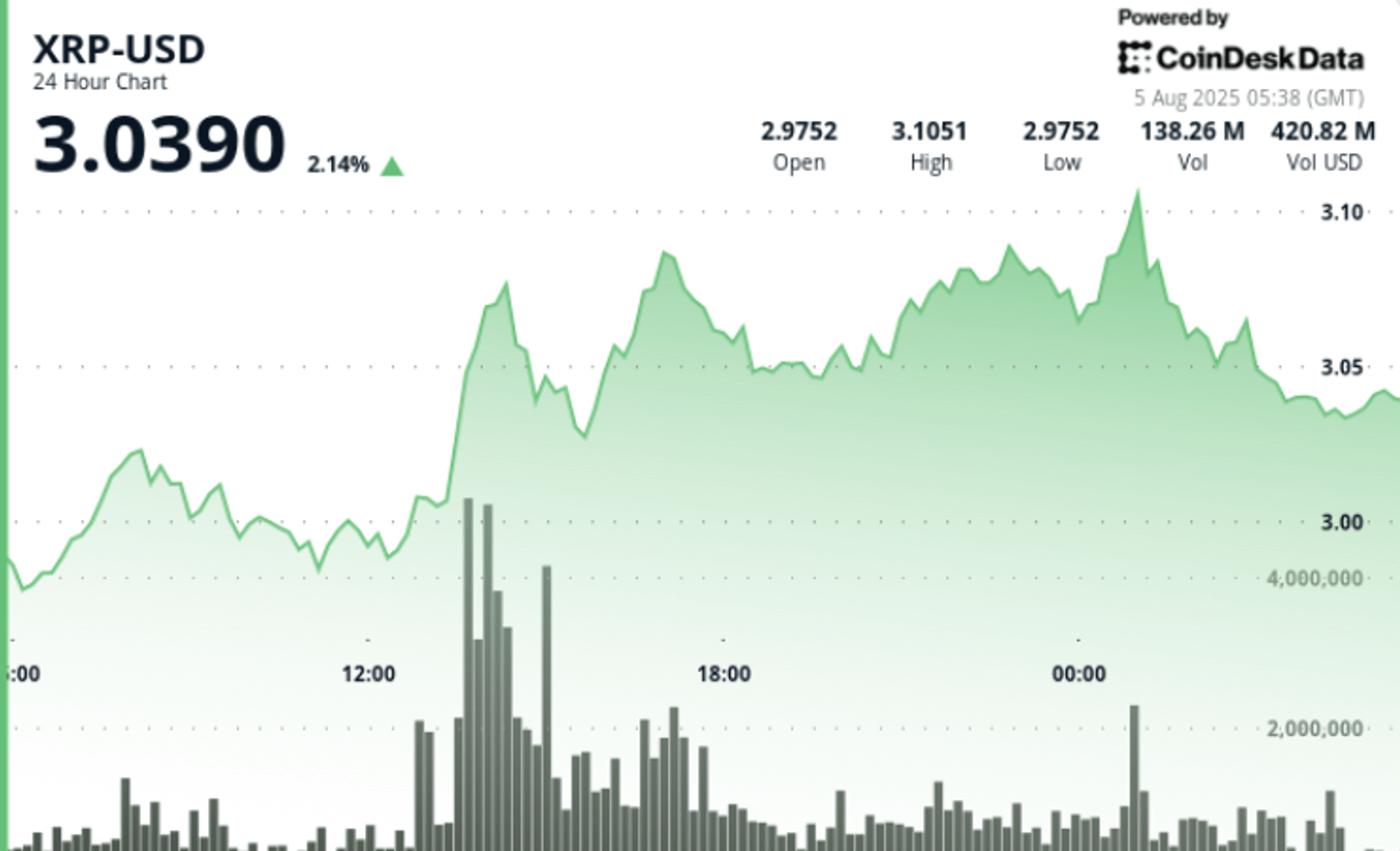

XRP increased to $ 3.05 during a 24 -hour volatile period, displaying a gain of $ 2.45% while traders reacted to tiny volumes and unprecedented whale liquidations.

An increase of $ 33 million in volume was recorded in a single minute, marking one of the largest points of this type for the token.

Despite the technical resistance at $ 3.09 and the flashing short -term sales signals, automatic learning forecasts continue to increase around $ 3.12 by the end of the month.

What to know

- XRP gathered from $ 2.92 to $ 3.05 between August 3 at 9 p.m. and August 4:00 p.m., winning 4.45% with a negotiation range of $ 0.18 (distribution of 6%).

- The psychological level of $ 3.00 was violated during the session from 1:00 p.m. to 2:00 p.m. on an extreme volume, culminating at 151.97 million professions.

- Institutional trading sparked $ 2.10 billion in sales flows, even if long -speaking positions totaling $ 14 million have been opened on major scholarships.

- A volume record of $ 33 million was observed at the top of the break.

- The AI trading models from several platforms provide $ 3.12 on August 31, despite the next update of the SEC regulatory status on August 15.

- The TD sequential indicator has flashed a sales signal on the three -day graph, which suggests that a short -term summit could form.

New context

The price peak followed a broader risk decision on cryptographic markets while merchants have shot altcoins at low prices and in high liquidity majors.

However, data on the chain have revealed aggressive sales flows from whale addresses and intelligent monetary funds – by worrying that the rally may have been motivated by short -term positioning before regulatory catalysts.

The dry should clarify the treatment of XRP securities in mid-August, a potential binary event for the token.

Summary of price action

- XRP has reached intrajournal summits of $ 3.08 before disappearing slightly to close the session at $ 3.05.

- Price action has reversed $ 3.09, establishing the level as short -term resistance.

- Support was observed at $ 2.97 among the window from 05: 00 to 06: 00, with consecutive volumes of 57.65 million and 44.77 million.

- The last hour saw a variation of $ 0.01 between $ 3.04 and $ 3.05 with high intrabar volatility and no clear directional bias.

Technical analysis

- The price maintained above the psychological zone of $ 3.00 but failed to break despite massive volume overvoltages.

- TD SEQUENTIAL shows a sale signal at 9 counts on 3D, generally followed by consolidation or downward pressure.

- RSI on the 1h and 4h remains raised but has not crossed an extremely successful territory.

- The rejection of $ 3.09 amounted to 69.89 million volumes, well above the average of 24:200 hours of 62.11 million.

What traders look at

- If XRP can maintain support over $ 3.00 before weekends.

- The impact of the decision in mid-August of the dry on the classification of the XRP market.

- If institutional sellers return to $ 3.10 + or if a long exhibition is based at current levels.

- Price targets focused on automatic learning ranging from $ 3.10 to $ 3.12 at the end of the month, assuming volatility compresses.