What to know:

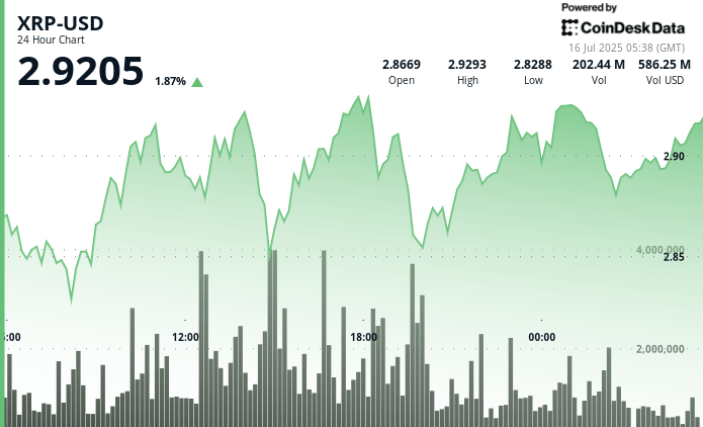

- XRP exchanged in a narrow variety of 4.08% between $ 2.82 and $ 2.93 from July 15 04:00 to July 16 03:00, ending at $ 2.89 for a daily gain of 1.8%.

- The escape from companies attempts $ 2.92 to $ 2.93 stranded four times (12 p.m., 1 p.m., 5 p.m., 6 p.m.) as the coordinated institutional sale has emerged.

- Market manufacturers and treasury offices provided solid support around $ 2.85, with volumes exceeding the daily average of 78.9 million at 2:00 p.m. and 7:00 p.m. for accumulation windows.

- The last hour of $ 2.88 to $ 2.90 (+ 0.69%) occurred after a drop to $ 2.87, supported by 2 million gusts of tokens volume – classic institutional imprint.

New context

While the FNB XRP Futures of Proshares is approaching its launch of July 18, the institutions seem to be aggressively rotating positions around the key thresholds.

While $ 3.00 remains the title of title, the sale structured at $ 2.93 and a coherent purchase activity around $ 2.85 suggest a rebalancing tightly tightened by the offices of the corporate treasury.

The regulatory ambiguity continues to limit the increase, with several offices little willing to cross the complete allocation thresholds until the Flows ETF normalized.

Summary of price action

- Range: $ 2.82 → $ 2.93 | Tread: $ 0.12 = 4.08%

- Failure of eruptions: $ 2.92 – $ 2.93 Refusal at 12:00 p.m., 1 p.m., 5:00 p.m., 6:00 p.m.

- Support area: $ 2.85 of the request for 2:00 p.m. and 7:00 p.m.

- Final time (02: 33–03: 32): XRP went from $ 2.88 → $ 2.90 (+ 0.69%)

- Volume peaks: More than 2 million tokens exchanged at 02: 36–02: 42, confirming the accumulation

Technical analysis

- The price remains in the tight consolidation channel under $ 3.00 Psychological ceiling

- $ 2.85 continues to act as a key liquidity area, with a cash activity concentrated near this level

- Resistance at $ 2.93 holds – confirming short -term indecision

- Classic upper stocking model forming intradays, despite the upper -limit rejection

- The momentum requires a clear rupture greater than $ 2.93 with a volume greater than 100 million for continuation

What traders look at

- XRP will he break $ 2.93 before the launch of the ETF of July 18 or does it fade as a drift linked to the beach?

- The accumulation zones nearly $ 2.85 suggest positioning before the potential volatility peak

- Breakout above $ 3.00 would probably trigger business upgrades of companies through structured wallets

- Failure to contain $ 2.88 could relax the recovery structure and target a retain of $ 2.82

Take away

XRP is consolidated under pressure. The institutions accumulate – but do not yet commit $ 2.93.

The ETF catalyst is close. Until then, it is a volume game: the support at $ 2.85 contains the soil; Resistance at $ 2.93 costs the ceiling. Break either – and the momentum will follow.

Warning: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.