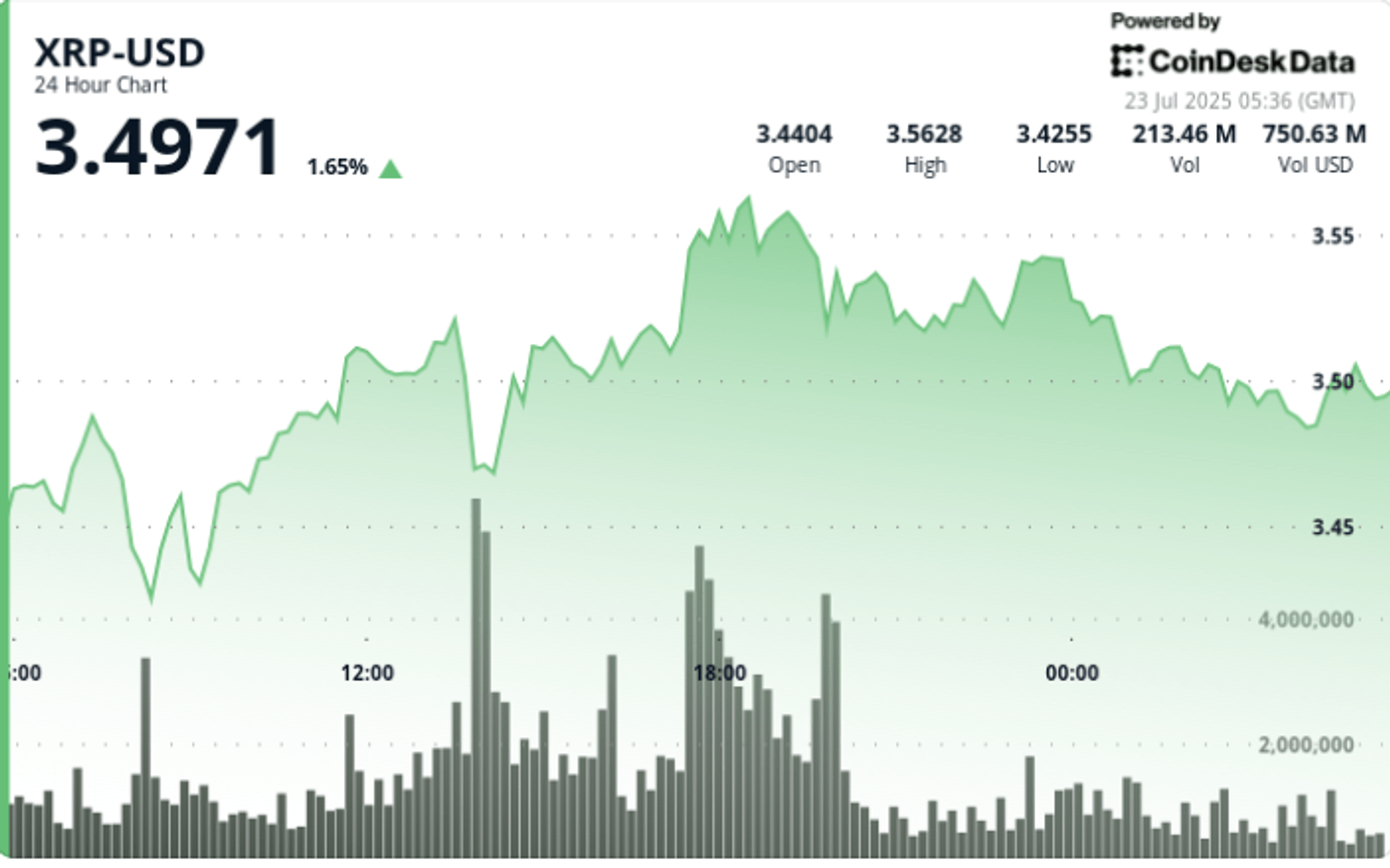

XRP posted a gain of 4% during the 24 -hour negotiation window from July 22 at 3:00 a.m. to July 23 at 2:00 a.m., prices traveling between a hollow of $ 3.42 and a summit of $ 3.57 before closing almost $ 3.51.

This decision follows a technical escape from a six -year symmetrical triangle and coincides with key developments in American cryptography legislation and the launch of institutional investment products.

Despite the bullish momentum throughout the day, the institutional sale emerged during the last hour of negotiation, the implementation gains and the signaling of a possible short -term consolidation.

New context

- The US Congress has advanced acts of engineering and clarity, establishing a legal framework for digital assets and reducing uncertainty concerning the classification of XRP security.

- Proshares launched the first ETF XRP Futures, a milestone for institutional adoption.

- Wall Street analysts issued price targets of $ 6.00 on XRP after confirmation of the triangle escape, with longer -term projections reaching up to $ 15.00.

Summary of price action

XRP exceeded the resistance of $ 3.52 during the window of 17: 00 to 18: 00 on the volume of 106.4 million, or 52% greater than the average of 24 hours of 70.1 million. The escape propelled the prices to the session of $ 3.57 high before selling the pressure in the last hour which had the prices brought to $ 3.51.

The last 60 -minute window from 01:09 to 02:08 GMT showed distribution behavior. Prices went from $ 3.50 to $ 3.52 per 01:46 before reversing. A high volume drop of 2.25 million units between 02: 02–02: 03 marked the most intense sale of the day, pushing prices to $ 3.50 before a marginal recovery.

Technical analysis

- Symmetrical escape from the triangle confirmed above $ 3.00 with a summit of $ $ 3.64 earlier in the week.

- Resistance: $ 3.57 (intrajournal), with a strong diet in general costs observed in the last hour.

- Support: $ 3.42 have successfully retests several times, confirming a solid institutional supply area.

- RSI and MacD remain neutral, suggesting a limited short -term dynamic.

- Analysts maintain the short -term objective of $ 6.00; $ 15.00 reported as long -term projection depending on the breakdown.

What traders look at

- If $ 3.50 is a level of psychological and technical support in the coming 24 hours.

- The purchase interest in monitoring the development of post-andF institutions.

- Congress momentum on a new regulation of digital assets.

- Developments of ETF Spot and their influence on a wider exposure to investors.

Warning: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.