XRP faced intense selling pressure at key support levels before a dramatic high-volume V-shaped reversal signaled a potential exhaustion of bearish momentum.

News context

This decline occurred against a backdrop of mixed institutional signals and increased macroeconomic uncertainty. Crypto markets remain trapped in a medium-term downtrend, with sentiment stuck in the fear zone as volatility increases among the majors.

Canary Capital’s recently launched US XRP Spot ETF (XRPC) saw first-day volume of $58.6 million, far exceeding analyst expectations of $17 million. Yet these strong starts failed to stabilize XRP as derivatives markets issued signals of tension. Around $28 million in XRP liquidations were hit in 24 hours, with long positions accounting for almost $25 million of the wipeout.

Market analysts warn that institutional flows remain conflicted: ETF inflows are showing interest, but broader pressure of risk aversion continues to suppress liquidity and momentum from cryptocurrencies.

Price Action Summary

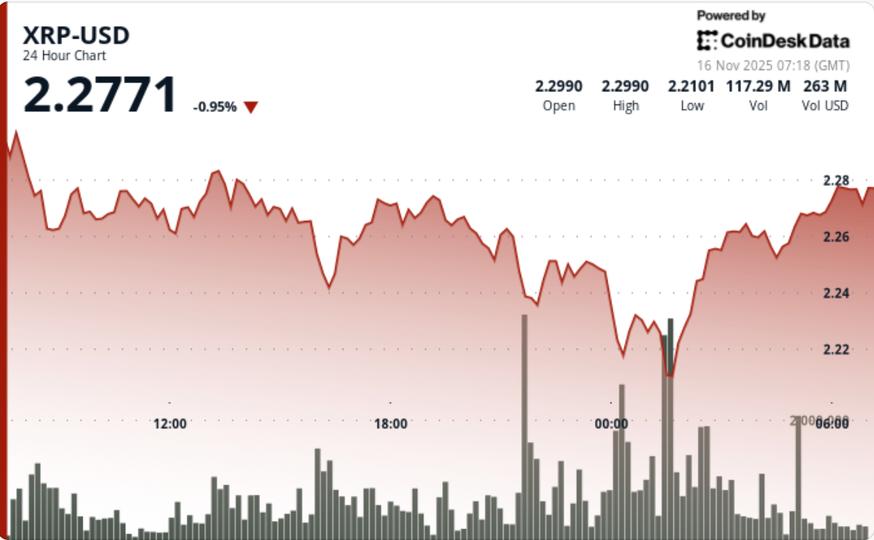

XRP fell 4.3% from $2.31 to $2.22 during the 24-hour session ending November 16 at 02:00 UTC. The decline carved out a $0.10 range with a clear sequence of lower highs confirming the bearish structure.

The most aggressive selling occurred at 00:00 UTC, when 74 million XRP traded – 69% above the 24-hour average – breaking $2.24 support. The price slipped to $2.22, marking the session’s low. Three distinct volume peaks above 57 million during decline phases validated sustained distribution.

Despite the ETF’s catalyst, the selling accelerated as the price rejected $2.31 and failed to find support near previous consolidation zones. The pair settled into a tight consolidation from $2.22 to $2.23 after the breakout.

Technical analysis

Support/Resistance:

- Main support: $2.22 (low capitulation)

- Immediate resistance: $2.23 to $2.24 breakdown zone

- Critical Fibonacci support: $2.16 (0.382 retracement) – loss from this level risks falling quickly towards $2.02 – $1.88

Volume profile:

- Distribution volume: 74M XRP (+69%) confirming capitulation

- Two reversal phase peaks (01:39, 01:46): 4.7M each, signaling sales exhaustion

- The recovery experienced a normalized but stable volume, consistent with the interest in bottom fishing

Chart structure:

- Price overnight reached support, printing a classic V-shaped reversal

- Higher lows formed at $2.209 → $2.217 → $2.227, indicating a change in momentum

- However, the broader downtrend from $2.31 remains intact pending resistance recovery.

- Failure to break through the $2.23-$2.24 zone limits upside tracking

Dynamic indicators:

- Oversold intraday conditions triggered reversal, but daily trend bias remains bearish

- The 50D/200D structure is tilted downward, adding overhead pressure

What Traders Should Know

XRP finds itself at a tactical turning point after a dramatic disaster:

- Holding $2.22 is crucial – failure exposes a direct move towards $2.16, then between $2.02 and $1.88.

- A confirmed recovery of $2.24, followed by $2.31, is needed to rebuild the bullish structure.

- ETF Flows Will Influence Volatility – Track Early XRPC Volumes as US Market Opens

- The V-shaped rebound provides short-term relief, but significant resistance limits the immediate upside.

- A sustained break above $2.48 is needed to bring the trend bias back towards targets above $2.60.