What to know

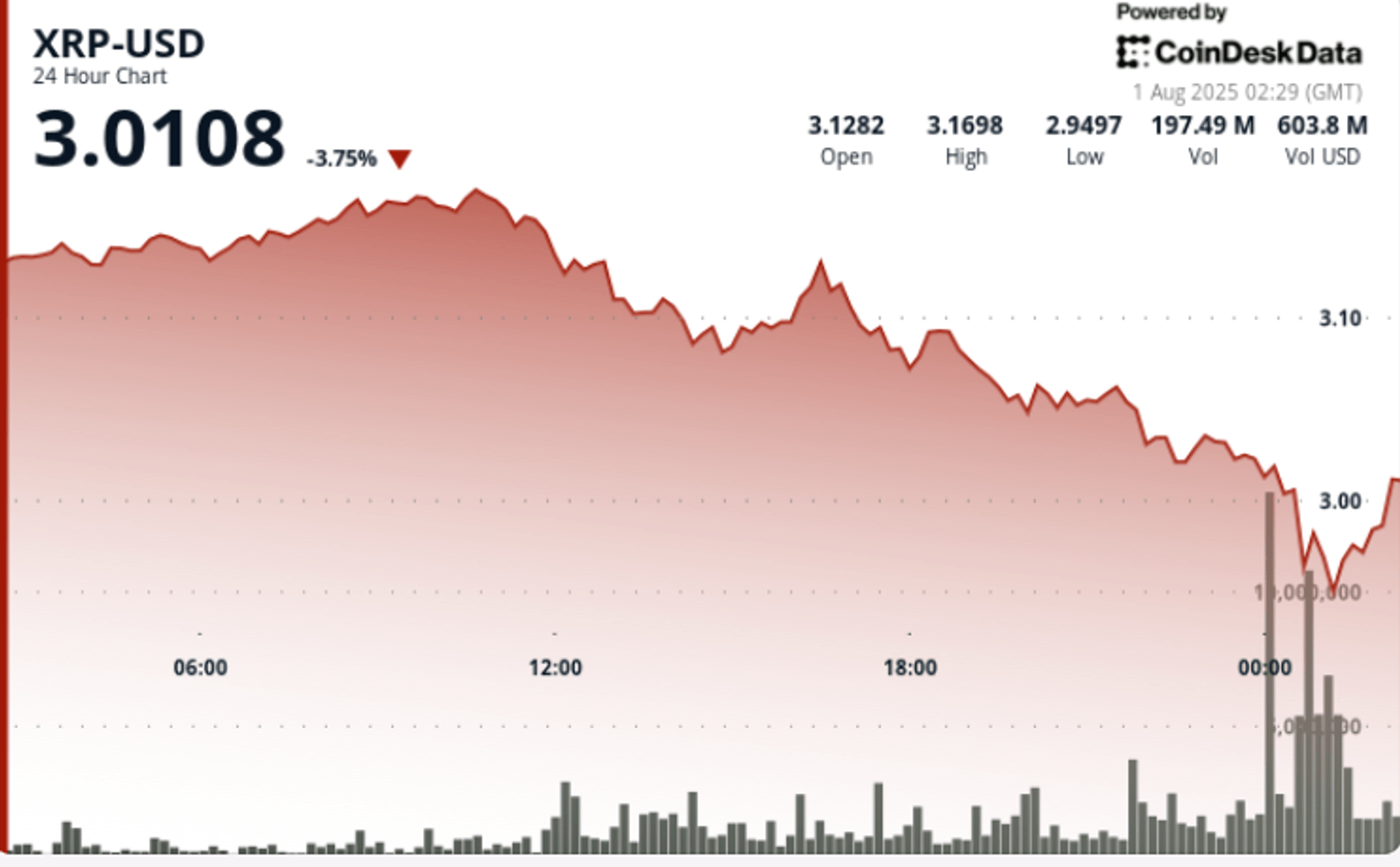

XRP decreased by 8% in the last 24 hours, going from a session of $ 3.17 to a minimum of $ 2.94, because an intense sale pressure submerged the initial resistance. The highest decline occurred during the midnight trading window on August 1, when XRP dropped 2.7% in one hour, accompanied by 259.21 million units in volume, which is on average 4X its average of 24 hours.

Despite the downward trend, the accumulation signals surfaced during the recovery phase, while XRP rebounded at $ 2.98. The volume decreased after initial volatility, which suggests that institutional buyers intervened to absorb excess food near the key support areas.

New context

The activity of whales surrounding XRP continues to provide mixed signals. On the one hand, the large supports were roughly liquidated $ 28 million from XRP per day Over a period of 90 days at the end, according to data on the chain. This trend highlights the persistent distribution between institutional holders and the first.

At the same time, on 310 million XRP tokens – have evaluated nearly $ 1 billion – have been accumulated During the recent correction phase, as the exchange balances have dropped sharply, signaling a sustained capital of capital.

Adding to the cross currents, Maxwell Stein, director of digital assets of BlackRock, confirmed participation in Ripple 2025 swell conferenceAlluding to the growing institutional alignment despite the recent price pressure.

Summary of price action

• High: $ 3.17 (10:00 am UTC, July 31)

• Weak: $ 2.94 (00:00 UTC, August 1)

• Change 24 hours: -8%

• Office point: $ 3.02 → $ 2.94 (midnight fall)

• Surge in volume: 259.21 m units during correction vs 64.89 m

• Closing price: $ 2.98 (marginal recovery by session closure)

The XRP fence price nearly $ 2.98 represents a minor of restoring session, but still signals a wider structural weakness. The short -term feeling remains fragile in the midst of liquidation flows and technical failures below the $ 3.00 threshold.

Technical analysis

The $ 2.94 support area held firm during several intraday tests, reinforced by an aggressive drop purchase which allowed prices to recover $ 2.98 per end of session. The resistance remains the general costs of $ 3.02 to $ 3.05, with continuous rejection, unless the punctual entries resume.

Momentum indicators remain biased, although the recovery volume profiles suggest a little exhaustion in the sale.

What traders look at

• The question of whether $ 2.94 to $ 2.95 is a short -term structural support

• Signs of renewed whales or a break in distribution trends

• Blackrock’s positioning in front of Ripple Swell 2025 and its implications for future stories linked to ETF XRP

• Reaction to the resistance band from $ 3.00 to $ 3.05, which previously marked the levels of distribution of keys