Bitcoin (BTC) reached nearly $ 82,000 early Thursday to order the gains on the cryptography market after a tour in hand on the prices led to relief on broader stock markets on Wednesday, caused by President Donald Trump changing CAP on a global tariff withdrawal.

XRP and Ether (ETH) led to gains among Crypto majors with a overvoltage of 12%, while the Cardano ADA, BNB of the BNB chain, Solana soil and Dogecoin (DOGE) have zoomed up to 10%. Global market capitalization increased by 6%. The Coindesk 20 based (CD20) has shown a 7%increase.

Future cryptocurrencies have shown short liquidations of more than $ 350 million, the highest since early March, which has helped to facilitate losses on Monday and Tuesday while Bitcoin plunged to almost $ 75,000 at a given time.

Such liquidation events often have a market purchase opportunity, as Coindesk noted on Monday, as they can report a too extensive market which indicates that prices correction has occurred, among other factors.

Elsewhere, the Bittensor Tao, the S and the Flare of Sonic were up to 30% to carry out gains among the intermediate averages, or token lower than a market capitalization of $ 5 billion.

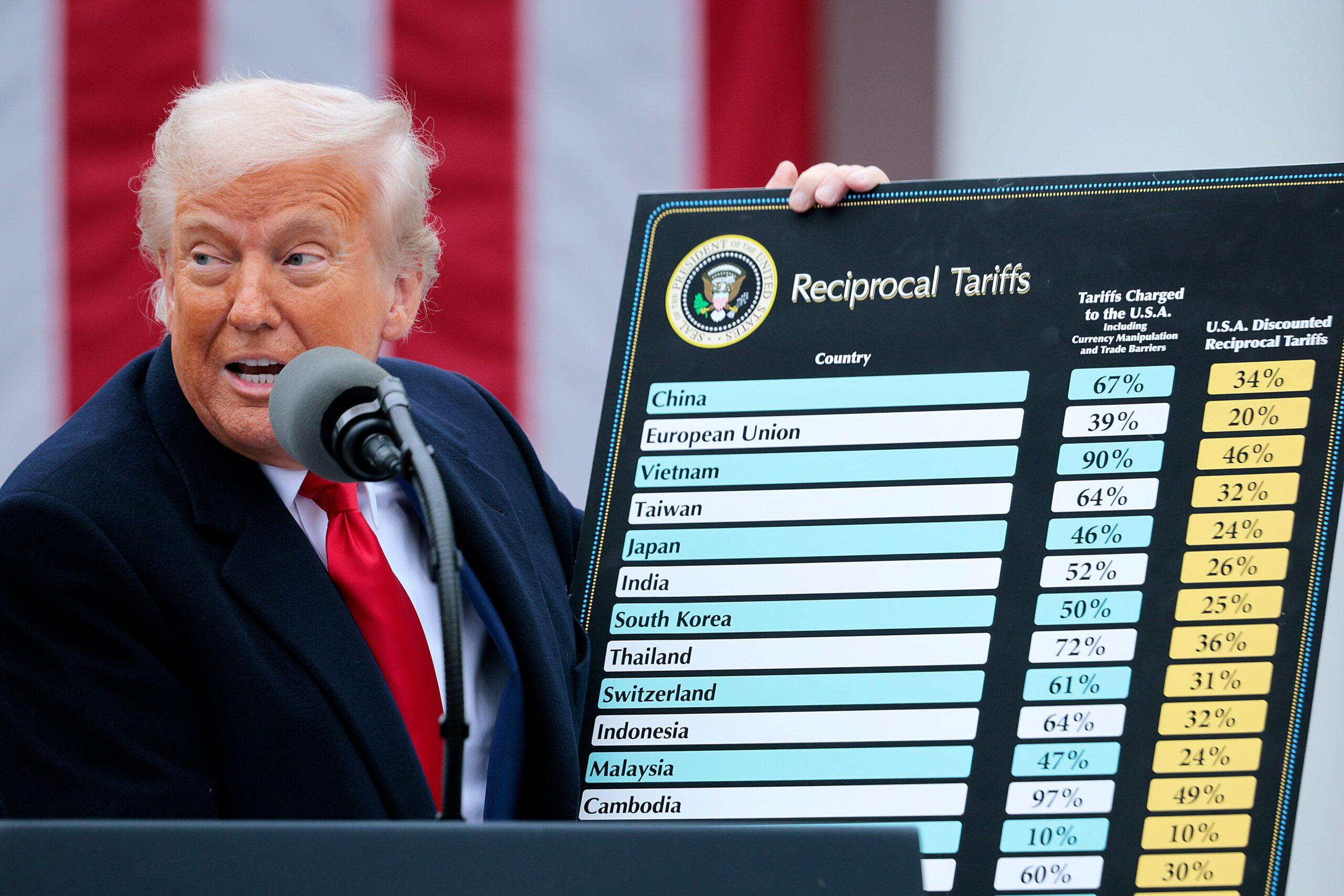

Thursday’s jump came while Trump interrupted higher prices on all countries, with the exception of China, where he increased the tax to 125%, in the midst of the growing concerns of world leaders and fears of recession. Countries that have been struck by higher reciprocal rights that have entered into force on Wednesday will now be taxed at the previous reference rate of 10% applied to other nations.

American actions have organized their best gathering since 2008. The S&P 500 index has climbed 9.5%, bouncing from the bear market territory, while the Nasdaq 100 of technology jumped 12%.

As such, traders continue to look at developments for clues on positioning in the middle of uncertainty.

“The market is gathering in response to the anticipation that most business partners will negotiate trade agreements with the United States, avoiding a full-fledged trade war,” COO in BTSE, Coindek in a telegram message. “That said, the continuous prices against China and Vice Versa will lead to a realignment of world trade which could radically change the functioning of the world. We remain cautious until we see the consequences of this game in the coming months.”

Jupiter Zheng, partner of Hashkey Capital, reported a possibility that markets reach a local background.

“The recovery was fueled by the optimism that the worst can be behind us. Although the potential winds remain, as the reprisal rates from China in response to the 125% increase in Trump, the start of negotiations with other countries offers a certain hope,” he said in an email.

“While American regulators continue to rationalize regulatory obstacles and implement more favorable policies, it is possible that Bitcoin and other cryptocurrencies have reached a background, assuming that no unexpected surprise emerges.