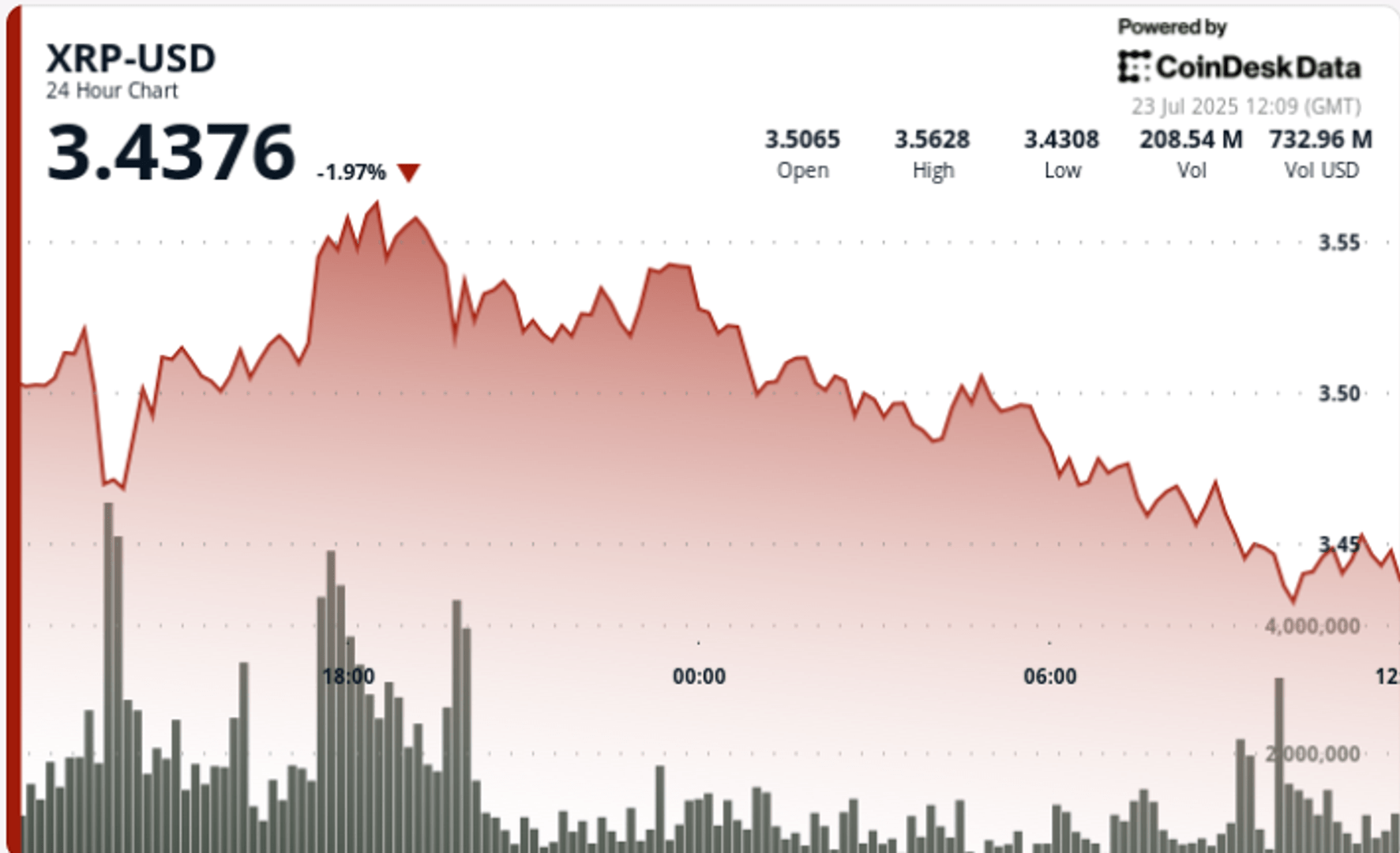

XRP exchanged in a wide range of $ 0.11 between $ 3.46 and $ 3.57 during the 24 -hour period ending on July 23 at 08:00 GMT. The assets displayed a 3% swing while the bulls led the price to a session summit of $ 3.57 out of 106.4 million volumes, before taking profits fell to $ 3.46.

The late decline broke the key support at $ 3.50, which had been reteteted several times during the night.

The volume has increased while institutional flows reacted to a confluence of catalysts: American cryptography legislation, fresh FNB approvals and the completion of the long -awaited technical models. Analysts always indicate in the long term price targets from $ 6 to 15, but provide for the risk of short -term consolidation.

New context

• XRP exceeded $ 3.65 last week, completing a six -year symmetrical triangle.

• Proshares launched the first ETF XRP Futures, marking an important step in regulated institutional access.

• The American Congress has advanced acts of engineering and clarity, advancing the clarity of cryptography regulations, the funds for funds in large capitalization assets.

Summary of price action

The most aggressive move arrived at 5:00 p.m. GMT on July 22, when XRP increased from $ 3.52 to $ 3.56 in less than an hour out of 106.4 million volumes, or 50% higher than the daily average of 70.1 million. Resistance formed in the $ 3.56 at $ 3.56 area, capping upwards and triggering a regular retirement through the night session.

The last hour (07: 10-08: 09 GMT) experienced a break from $ 3.47 to $ 3.46, because the volume increased to 2.5 million between 07:37 and 07:49. This decision made the support band from $ 3.49 to previously $ 3.51, confirming a short -term trend change by selling outdated buyers.

Technical analysis

• Negotiation range 24 hours a day: $ 3.46 to $ 3.57 (3.18%)

• Handy escape at 5:00 p.m. July 22: $ 3.52 → $ 3.56 over a volume of 106.4 million

• Assistance zone: $ 3.49 – $ 3.51 tested several times during the night, stranded by session closed

• Resistance zone: $ 3.56 – $ 3.57 capped rally, now defining the next break point

• Panne confirmation: $ 3.47 → $ 3.46 on a volume peak of 2.5 million

• RSI neutral; MacD Turns lower – Signals probable consolidation before the following directional movement

What traders look at

Institutional participation remains high in the middle of FNB entries and improving the regulatory optics. Despite short-term rejection at $ 3.57, analysts continue to report bullish configurations targeting $ 6.00 and even $ 15.00 over multi-house deadlines. The level of $ 3.50 is now acting as a psychological pivot for bulls to be defended during future sessions.