Islamabad:

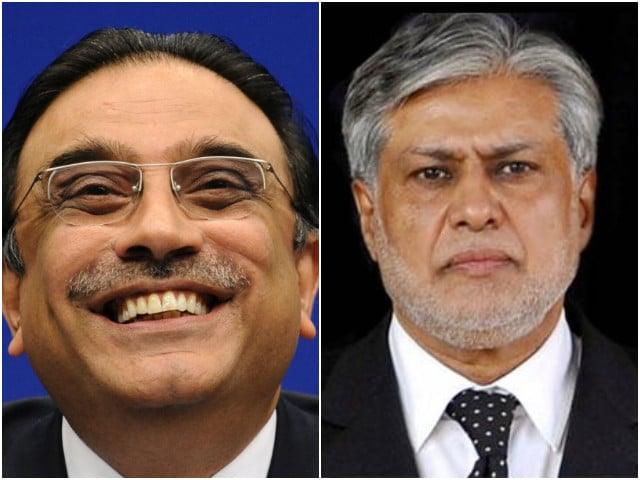

The substantive contacts between President Aif Zardari and Vice-Prime Minister Ishaq Dar led to a breakthrough on the issue of the new law on agricultural income tax, introduced into the Sindh on Monday, after all The previous efforts of the federal government have failed to break the dead end, initiated on Tuesday revealed.

Government sources have told the Express PK Press Club that the multiple attempts of the Ministry of Finance to convince the Sindh government to immediately introduce the agricultural income tax regime to save the international monetary fund program (IMF ) had failed.

They said this due to the delay of more than four months of passage and implementation of the law; The IMF was not ready to give dates for the first talks in the journal. This had also been disclosed by the head -to -chief of Sindh, Murad Ali Shah, on the chamber’s prosecution, while speaking of the legislation.

“We have been told without the IMF team would not come, and the country would be lacking if the agricultural tax bill was not adopted in a law,” said chief minister Shah to the Session of the Sindh Assembly.

After the efforts of the Ministry of Finance remained unsuccessful, the sources said, Ishaq Dar with the economic team visited the presidency a few days ago to convince the president in the matter.

The president first declared that he would ask the Sindh government to present the bill after his return from a five -day visit to China that began on Tuesday.

However, on the insistence of DAR, the president immediately phoned the chief minister Shah, as well as the chief minister of Balutchistan, Sarfaraz Bugti, to introduce new bills in their respective provincial assemblies to receive the agricultural income tax in the two provinces.

According to sources, the government has recognized Dar’s positive contribution to convince him President Zaradri in order to remove a major obstacle in the way to the IMF visit. A manager of the Ministry of Finance said that DAR’s political sense had helped achieve the result, the ministry had tried to achieve in recent months.

On Monday, after the Sindh Assembly, unanimously adopted the bill on the income tax law of the Sindh income, 2025, the Minister of Finance Muhammad Aurangzeb thanked the provincial governments for having implemented the key condition of the IMF.

The Ministry of Finance is now confident about the success of the first review of the IMF program. Last week, Aurangzeb said that the IMF team could come at the end of February or early March.

The IMF had imposed the condition that provincial governments increase the abysics agricultural tax rate to 45% and impose up to 10% super tax on high income owners.

At the end of October, “each province changes its legislation and the agricultural income tax regime to fully align it with the federal income tax regime for small farmers and the federal tax regime The income of companies for commercial agriculture, so that the tax can start from January 1 of January 1, 2025, “according to documents from the IMF program.

The deadline was missed by all provincial governments, but later the provinces began to introduce these laws due to the difficult position of the IMF. The national tax pact, signed by all the provinces, also said that the provinces would tax agricultural income as part of a new regime from January 1, 2025, with a collection for the second semester for the year 2024-25 .

Currently, federal tax rates for individuals are as high as 50% and companies are 29%, excluding income tax. Even the head of the IMF mission in Pakistan, Nathan Porter, said in internal meetings that his fingers had been crossed with regard to the introduction of the Act on Avenir income tax in the Sindh, indicated the sources.

The sources have indicated that the IMF should now communicate a date for the examination mission and that its successful completion would unlock the second loan section worth more than a billion dollars.

Speaking on the ground of the House, the Minister -in -chief Shah had criticized the federal government for not having engaged the provinces in talks with the IMF, although agricultural tax was a provincial affair.

The Sindh agricultural income tax invoice proposes that an annual agricultural income of up to 600,000 rupees is exempt from tax, while the maximum tax rate for income greater than 5.6 million rupees per year will be 45%.

A super progressive tax has also been introduced; Without great annual agricultural income tax of up to 150 million rupees and a maximum of 10% of super taxes applying to income exceeding 500 million rupees per year. For small agricultural businesses, the new rate will be 20% and for large companies, it will be 29%, excluding the impact of the super tax.