Islamabad:

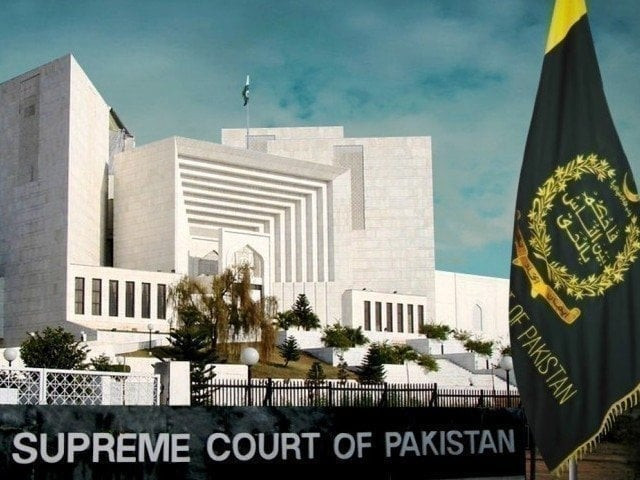

On Wednesday, the Supreme Court raised strong questions on the government’s taxation of the super tax, the judges warning that the burden of these samples finally fell from ordinary citizens and discouraged taxpayers.

A constitutional bench of five members, led by Judge Amicin Khan, resumed the hearing in the case contesting the Super Tax. During the hearing, lawyer Asma Hamid appeared on behalf of the Federal Board of Return (FBR).

Sitting on the bench, judge Muhammad Ali Mazhar pointed out that if it was a bag of cement or a shipment with liquefied natural gas (LNG), “the whole burden consists of the ordinary man”, adding: “Business will flourish, if we make things easier for people”.

Justice Jamal Khan Mandokhail echoes concern, warning: “Do not discourage taxpayers – when you do, people end up leaving the country.”

The bench pressed the FBR on the reasons for which Parliament had created distinctions among taxpayers. Judge Mandokhail said neither the government’s decisions nor the law herself explained the justification for such differentiation.

The FBR lawyer, Asma Hamid, argued that the High Court of the Sindh (SHC) and the High Court of Islamabad (IHC) had not asked for any data on the issue, and said that the Super Tax was only applied 15 sectors whose income exceeding 300 million rupees.

She argued that no business had claimed an inability to pay. But judge Mazhar stressed that the “real problem is the reason why there is a distinction among taxpayers”, stressing that budgetary measures should not end up rejecting the burden to the public.