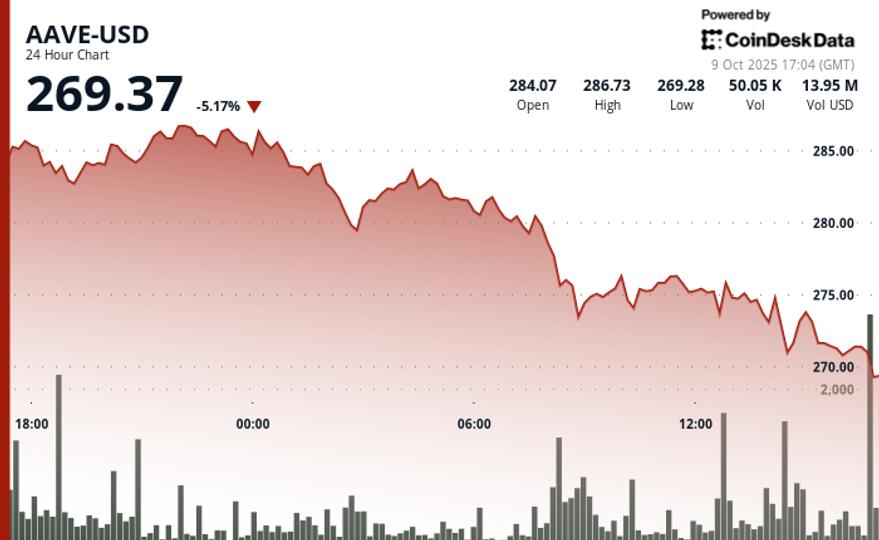

The governance token of major decentralized lending protocol Aave faced significant selling pressure over the past 24 hours, briefly falling below the $270 level.

The DeFi bluechip plunged 5% early in Thursday’s session, sliding nearly 10% from this week’s high. It recovered slightly later in the day during US hours, changing hands at around $272.

The price action came amid a weak session for cryptocurrencies, with bitcoin on the verge of falling below $120,000. The broader market CoinDesk 20 Index fell more than 4% during the day.

The technical picture shows bearish momentum for the DeFi major, suggests CoinDesk Research’s analysis model.

The loss of key support at $273 triggered a cascade of selling, accelerating the decline. Subsequent recovery attempts proved unsuccessful, with failed rallies confirming sustained selling pressure, the model suggests.

Key technical indicators

- Trading volume reached 63,651 units, significantly exceeding the 24-hour average of 31,013 units.

- Technical resistance established at the $280.00 level.

- A break below critical support at $273.00 triggered additional algorithmic liquidation.

- Several recovery attempts failed, indicating sustained selling pressure.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.