Dogecoin increased $ 0.27 on more than 1.1 million turnover, with whale wallets adding tokens of 30 million and speculation mounting around the potential inclusion of the pension fund. The support moved above in the $ 0.27 zone while the institutions crowded, with a momentum looking at the ceiling of $ 0.30.

New context

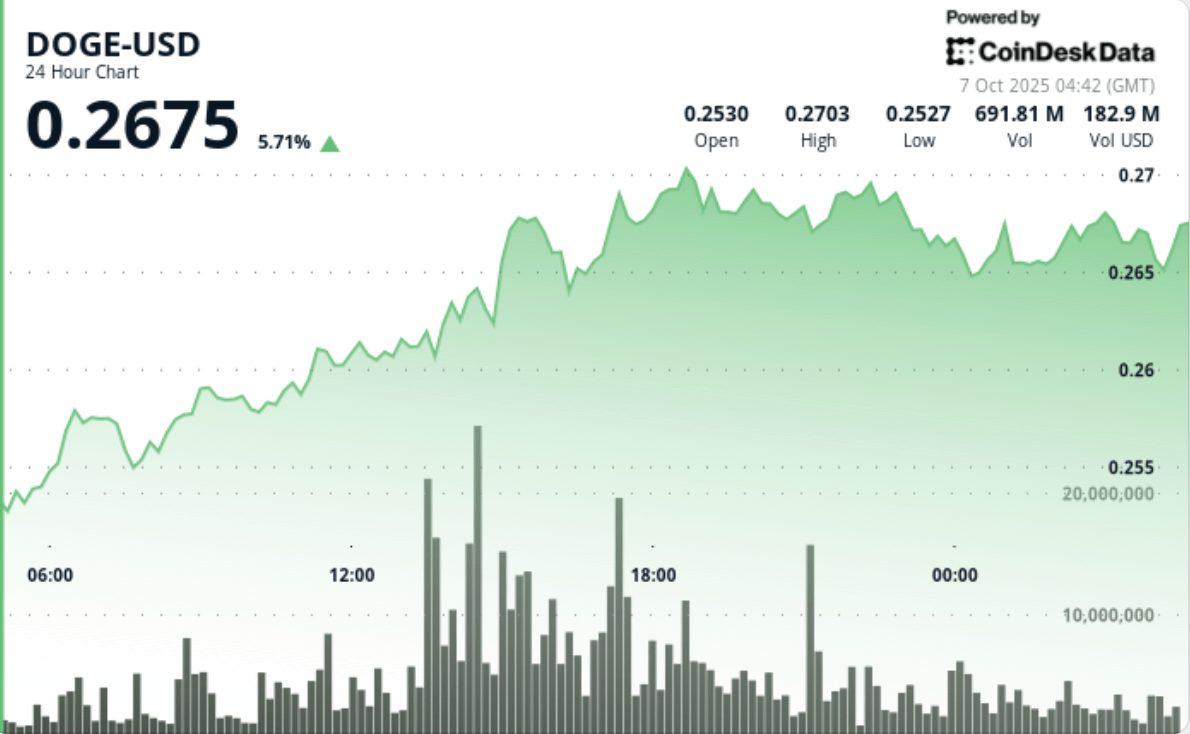

DOGE increased by 6% between October 6, 04:00 and October 7 03:00 am, from $ 0.25 to $ 0.27. The rally was supported by heavy accumulation flows – intermediate level supports and large additions of more than 30 million tokens – and exchange outings equivalent to 25 million dollars. The market chatter highlighted the approval ratings for the dry for 401 (K) eligibility, reflecting bitcoin and the integration of Ethereum’s retirement. Analysts reported ascending triangle training and cyclical signals targeting $ 0.30 to $ 0.35.

Summary of price action

- DOGE exchanged a 7% strip between $ 0.25 and $ 0.27.

- Breakout accelerated during the window from 2:00 p.m. to 3:00 p.m. on the 1.15b tokens, the heaviest turnover for weeks.

- The price reached $ 0.27 at the end of the afternoon, where new resistance emerged.

- The final session experienced a consolidation of around $ 0.27 with reduced volumes, considered as profits rather than a structural weakness.

Technical analysis

The support increased to $ 0.27 after several defenses, while the resistance is firm from $ 0.27 to $ 0.30. The structure of the graph reflects an ascending triangle, with higher bases pressing towards the ceiling. Analysts also highlight a 42 -day cyclic signal aligning with the attempted rupture. Surpinated closings greater than $ 0.27 are necessary to confirm the momentum to the area from $ 0.30 to $ 0.35.

Which traders are looking at?

- If Doge can return $ 0.27 in a sustainable medium.

- An escape at $ 0.30 to validate technical objectives in the area from $ 0.32 to $ 0.35.

- Confirmation of the accumulation led by whales when the exchange exits tighten the food.

- Potential regulatory securities on the eligibility of pension funds stimulate traditional flows.